Question: may Use this formula to solve Variable growth in dividends To further increase funding for the investment project, Cooper Technologies Ltd has decided to withdraw

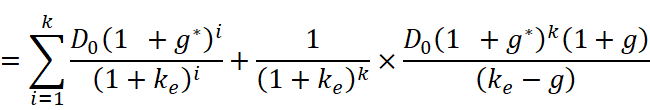

may Use this formula to solve Variable growth in dividends

To further increase funding for the investment project, Cooper Technologies Ltd has decided to withdraw dividend payments for the next two years (i.e., year 1 and year 2). Thereafter, the company expects to maintain an annual dividend growth rate of 8.4% for five years (i.e., year 3 to year 7). Afterward, the company expects to have an annual dividend growth rate of 4.2% and maintain it forever. The expected rate of return on the companys equity is 9.8% p.a.. The dividend per share in year 3 is $2. Calculate the price of each share in todays dollar (i.e., share price in year 0).

=i=1k(1+ke)iD0(1+g)i+(1+ke)k1(keg)D0(1+g)k(1+g)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts