Question: May you help me, please? Big Ltd. used the statement of financial position approach to estimate uncollectible account receivable. On 1 January 2021, The Allowance

May you help me, please?

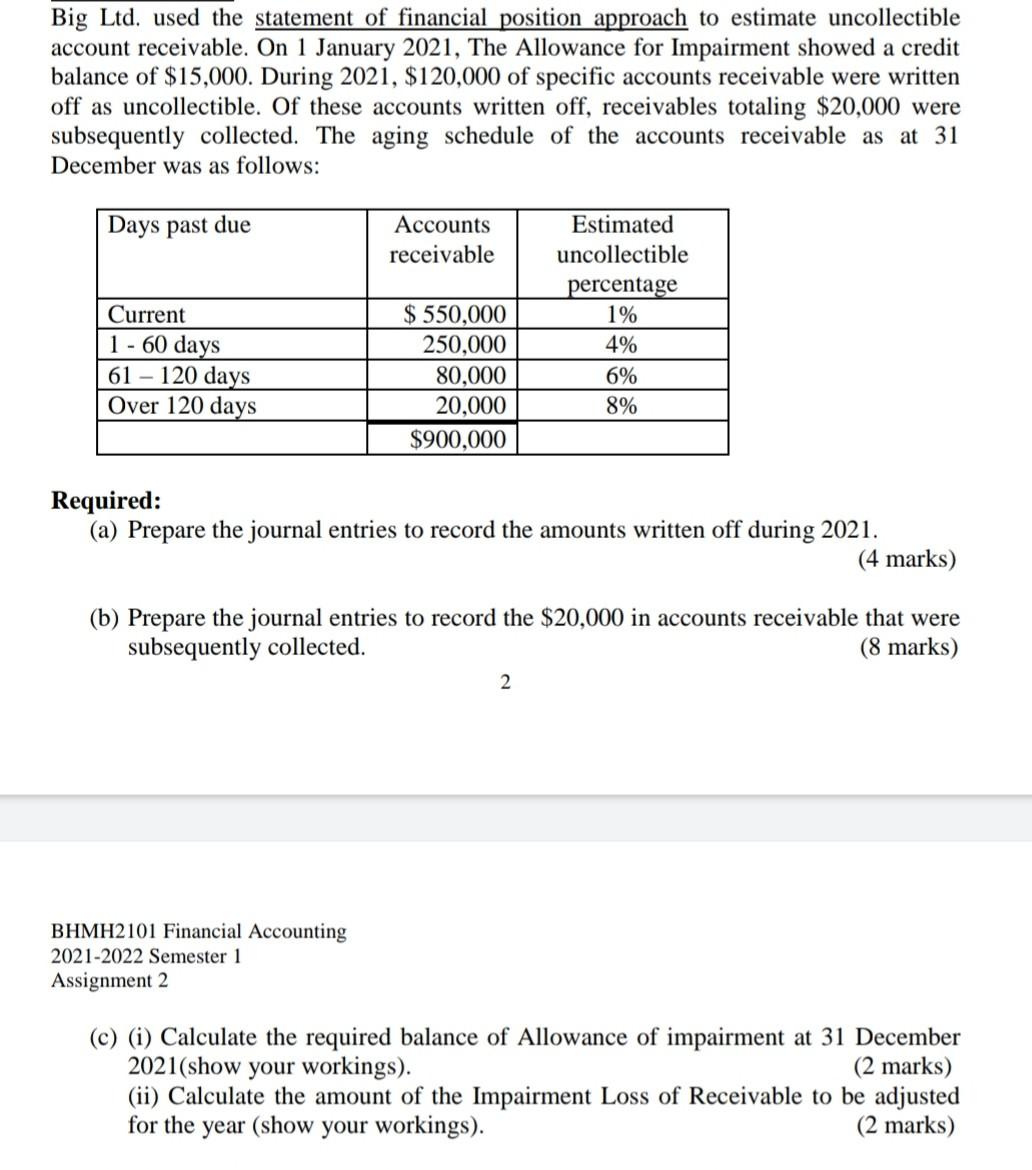

Big Ltd. used the statement of financial position approach to estimate uncollectible account receivable. On 1 January 2021, The Allowance for Impairment showed a credit balance of $15,000. During 2021, $120,000 of specific accounts receivable were written off as uncollectible. Of these accounts written off, receivables totaling $20,000 were subsequently collected. The aging schedule of the accounts receivable as at 31 December was as follows: Days past due Accounts receivable Current 1 - 60 days 61 - 120 days Over 120 days $ 550,000 250,000 80,000 20,000 $900,000 Estimated uncollectible percentage 1% 4% 6% 8% Required: (a) Prepare the journal entries to record the amounts written off during 2021. (4 marks) (b) Prepare the journal entries to record the $20,000 in accounts receivable that were subsequently collected. (8 marks) 2 BHMH2101 Financial Accounting 2021-2022 Semester 1 Assignment 2 (c) (i) Calculate the required balance of Allowance of impairment at 31 December 2021(show your workings). (2 marks) (ii) Calculate the amount of the Impairment Loss of Receivable to be adjusted for the year (show your workings). (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts