Question: May you please do C ei og i Data Table Selected balance sheet data at beginning of current year. er Supreme E-shop Balance sheet: Current

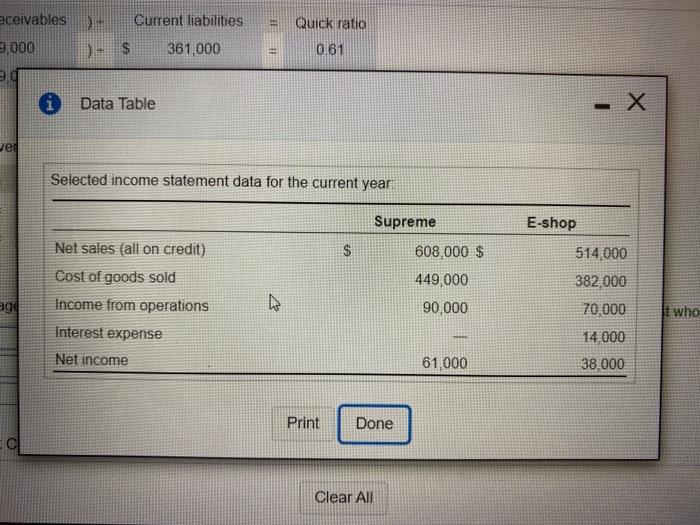

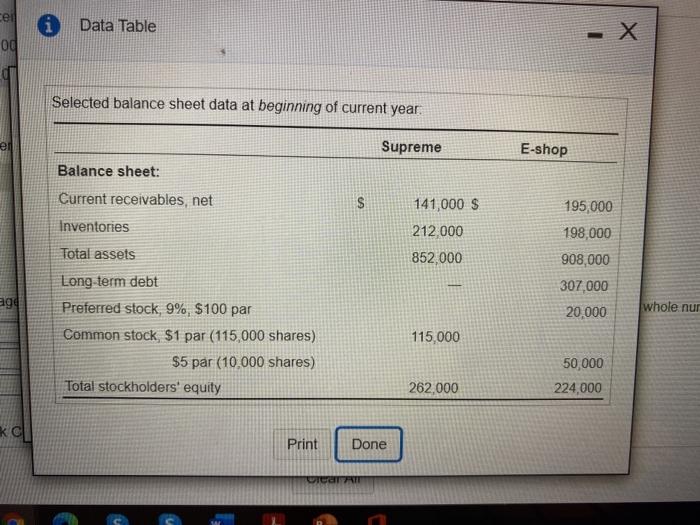

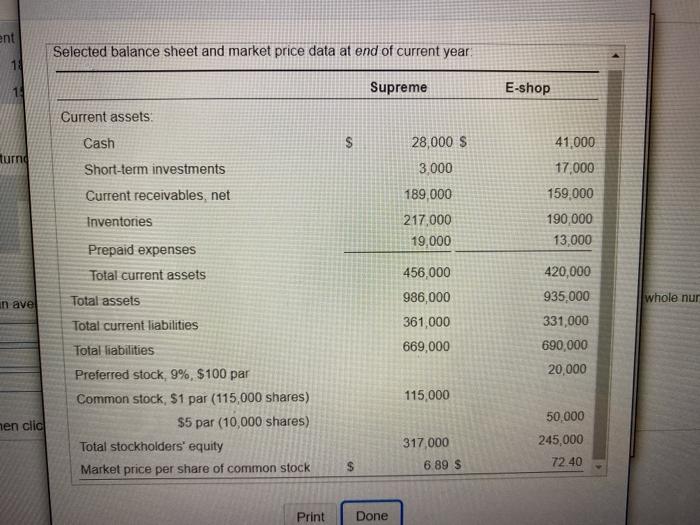

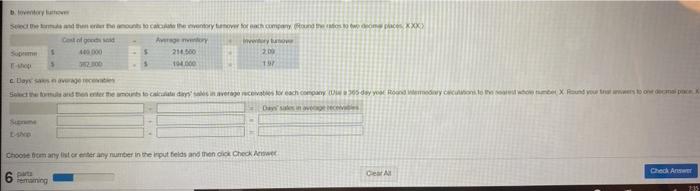

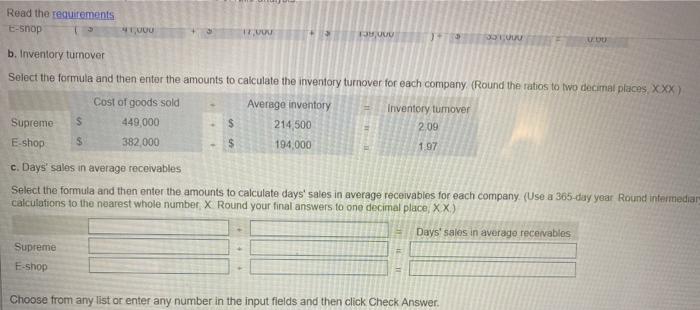

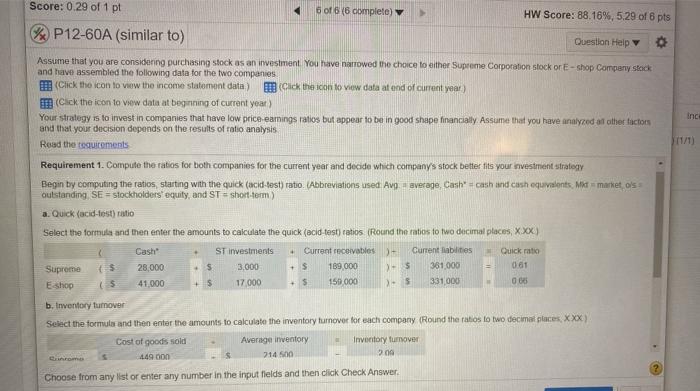

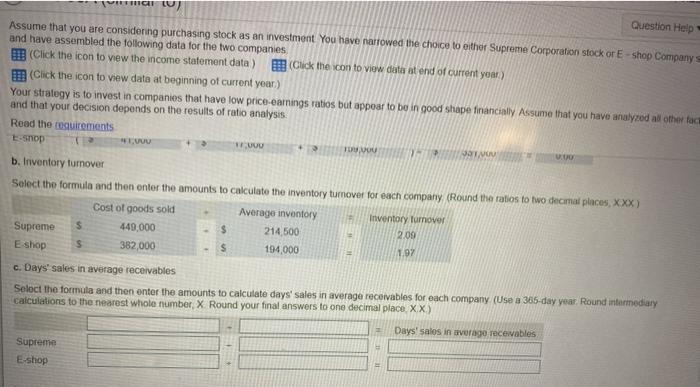

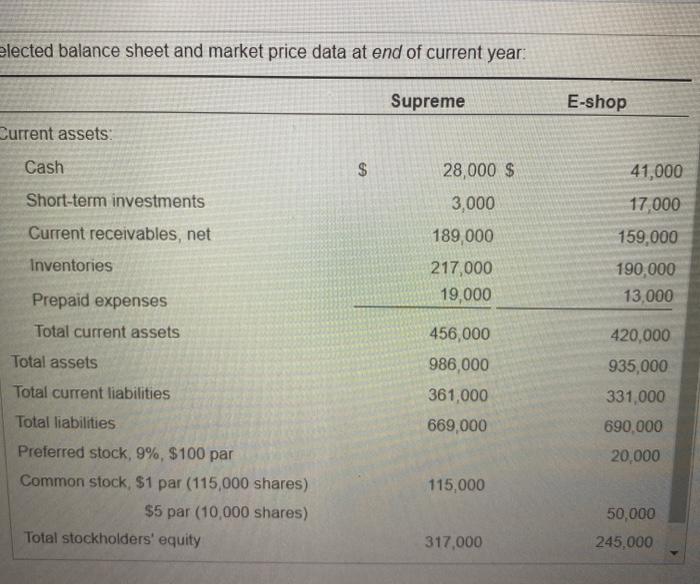

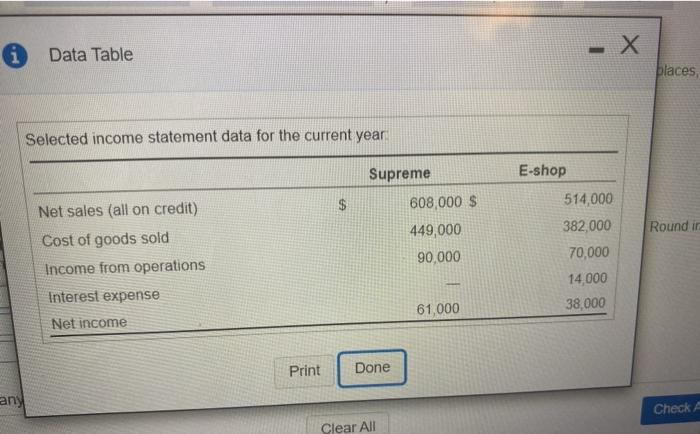

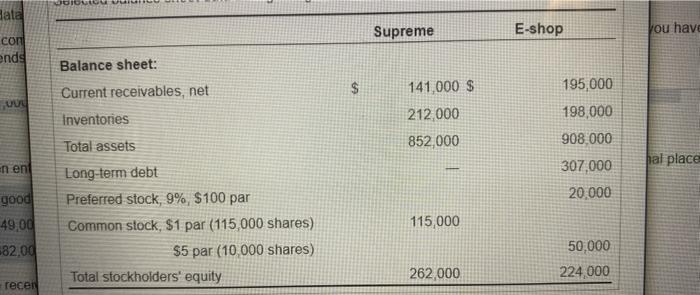

ei og i Data Table Selected balance sheet data at beginning of current year. er Supreme E-shop Balance sheet: Current receivables, net 195.000 Inventories 141,000 $ 212 000 852,000 Total assets 198,000 908,000 307,000 20,000 age whole nur Long term debt Preferred stock, 9%, $100 par Common stock, $1 par (115,000 shares) $5 par (10.000 shares) Total stockholders' equity 115,000 50 000 262,000 224,000 Print Done CERIT ent Selected balance sheet and market price data at end of current year 14 1-1 Supreme E-shop Current assets Cash $ turn Short-term investments Current receivables, net Inventories 28,000 $ 3000 189.000 217,000 19,000 41,000 17,000 159.000 190,000 13,000 Prepaid expenses Total current assets Total assets in ave whole nur 456,000 986,000 361,000 669,000 Total current liabilities 420,000 935,000 331,000 690,000 20,000 115,000 Total liabilities Preferred stock 9%, $100 par Common stock, $1 par (115,000 shares) $5 par (10,000 shares) Total stockholders' equity Market price per share of common stock hen clic 50.000 245,000 317,000 6 89 $ $ 72.40 Print Done Select there to cry orch.compound won c XXX) ger 40 216.500 200 10 197 caya Soundtheworld to calcun vero colechowyway yow Rood WoW X Rund um Day len LANO Choose tomany store any number in the put fields and then click Check parta DA Crec An 6 Read the requirements t-shop 1.UU 1. HUVU OU b. Inventory turnover Select the formula and then enter the amounts to calculate the inventory turnover for each company (Round the ratios to two decimal places XXX) Cost of goods sold Average inventory Inventory tumover Supreme $ 449,000 $ 214500 2.09 E-shop $ 382 000 5 194.000 197 c. Days' sales in average receivables Select the formula and then enter the amounts to calculate days' sales in average receivables for each company. (Use a 365-day year Round intermediar calculations to the nearest whole number, X Round your final answers to one decimal place XX) Days' sales in average receivables Supreme E-shop Choose from any list or enter any number in the input fields and then click Check Answer Score: 0.29 of 1 pt 6 of 6 (6 complete) HW Score: 88.16%, 5.29 of 6 pts BP12-60A (similar to) Question Help Assume that you are considering purchasing stock as an investment you have arrowed the choice to either Supreme Corporation stock or E-shop Company stock and have assembled the following data for the two companies (Click the icon to view the income statement data) Click the icon to view data at end of current year (Click the icon to view data at beginning of current year) Your strategy is to invest in companies that have low price earnings ratios but appear to be in good shape financially Assume that you have analyzed all other factors Inc and that your decision depends on the results of ratio analysis 11/1) Read the requirements Requirement 1. Compute the ratios for both companies for the current year and decide which company's stock better lits your investment strategy Begin by computing the ratios starting with the quick (acid-test) ratio. (Abbreviations used Avg. average, Cash = cash and cash equivalents. Midt market os outstanding SE = Stockholders' equity, and ST = short-term) a. Quick (acid-list) ratio Select the formula and then enter the amounts to calculate the quick (acid test ratios (Round the ratios to two decimal places, XXX) Cash ST investments Current receivables Current Habities Quick ratio Supreme 28,000 + S 3,000 $ 189.000 061 361 000 (5 Eshop 41,000 + S 17.000 + 5 159.000 000 331000 >- 5 + + - $ b. Inventory turnover Select the formular and then enter the amounts to calculate the inventory turnover for each company (Round the ratios to two decimal places XXX) Cost of goods sold Average inventory Inventory turnover Como 4.49.000 914 500 200 Choose from any list or enter any number in the input fields and then click Check Answer nar 0 Question Help Assume that you are considering purchasing stock as an investment You have narrowed the choice to either Supreme Corporation stock or E shop Companys and have assembled the following data for the two companies (Click the icon to view the income statement data) (Click the scon to view data at end of current your m (Click the icon to view data at beginning of current year) Your strategy is to invest in companies that have low price earnings ratios but appear to be in good shape financially Assume that you have analyzed as other face and that your decision depends on the results of ratio analysis Road the requirements E-shop NOU YOTUM TUUU b. Inventory turnover TO Select the formula and then enter the amounts to calculate the inventory tumover for each company (Round the ratios to two decimal places, XXX) Cost of goods sold Average inventory Inventory Turnover Supreme $ 449,000 $ 214.500 2.09 E shop s 382,000 194,000 1.92 c. Days' sales in average receivables Select the formula and then enter the amounts to calculate days' sales in average receivables for each company (Use a 305-day year Round intermediary calculations to the nearest whole number X Round your final answers to one decimal place XX) Days' sales in average recewables Supreme Eshop elected balance sheet and market price data at end of current year: Supreme E-shop Current assets Cash $ 41,000 Short-term investments Current receivables, net 28,000 $ 3,000 189,000 217,000 19,000 17 000 159,000 Inventories 190,000 13,000 Prepaid expenses Total current assets Total assets 456 000 986,000 361,000 669,000 Total current liabilities Total liabilities Preferred stock, 9%, $100 par Common stock, $1 par (115,000 shares) $5 par (10,000 shares) Total stockholders' equity 420,000 935,000 331,000 690.000 20,000 115,000 50,000 317,000 245.000 Data Table places Selected income statement data for the current year Supreme E-shop $ 608,000 $ 449,000 90,000 Net sales (all on credit) Cost of goods sold Income from operations Interest expense Net income Round ir 514,000 382,000 70,000 14,000 38,000 61,000 Print Done any Check A Clear All DIO lata con ende Supreme E-shop You have Balance sheet: $ wy Current receivables, net Inventories 141,000 $ 212 000 852,000 Total assets 195,000 198,000 908.000 307,000 20.000 hal place en en good 49.00 82.00 Long-term debt Preferred stock, 9%, $100 par Common stock, $1 par (115,000 shares) $5 par (10 000 shares) Total stockholders' equity 115,000 50,000 224,000 262,000 recen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts