Question: may you please help? please watch the tutorial video on Fixed Assets and Depreciation Methods: www.youtube.com/watchyWhWP 1. The understanding of this chapter will be helpful

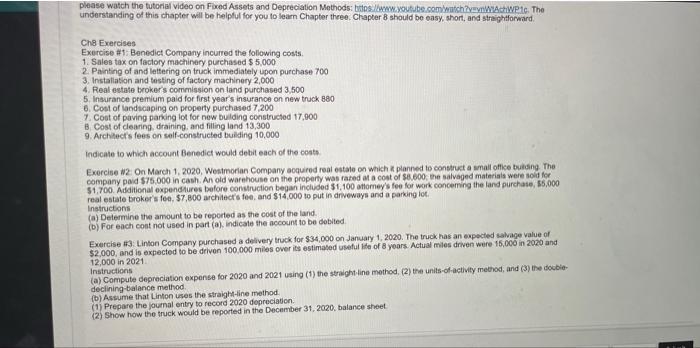

please watch the tutorial video on Fixed Assets and Depreciation Methods: www.youtube.com/watchyWhWP 1. The understanding of this chapter will be helpful for you to learn Chapter three. Chapter 8 should be easy, short, and straightforward ChB Exercises Exercise #1 Benedict Company incurred the following costs 1. Sales tax on factory machinery purchased $5,000 2. Painting of and lettering on truck immediately upon purchase 700 3. Installation and testing of factory machinery 2,000 4. Real estate broker's commission on land purchased 3,500 5. Insurance premium paid for first year's insurance on new truck 880 6. Cost of landscaping on property purchased 7,200 7. Cost of paving parking lot for new building constructed 17,900 B. Cost of cleaning, draining, and filling land 13,300 9. Architect's fees on self-constructed building 10,000 Indicate to which account Benedict would debit each of the cost Exercise W2 On March 1, 2020, Westmoran Company acquired real estate on which planned to construct a small office building. The company paid $75,000 in cash An old warehouse on the property was rared at a cost of $8.000, the salvaged materials were sold for 51,700. Additional expenditures before construction began included $1,100 otomay's fee for work concerning the land purchase, 55.000 real estate broker's foo, 57,800 architect's fee and $14.000 to put in driveways and a parking lot Instructions (a) Determine the amount to be reported as the cost of the land. (b) For each cost not used in part(a), indicate the account to be debited Exercise #3: Linton Company purchased a delivery truck for $34.000 on January 1, 2020. The truck has an expected salvage value of $2,000, and is expected to be driven 100,000 miles over its estimated Useful life of 8 years. Actual miles driven were 15,000 in 2020 and 12,000 in 2021 Instructions (a) Compute depreciation expense for 2020 and 2021 using (1) the straight line method, (2) the units of activity method, and (3) the double- declining balance method (b) Assume that Linton uses the straight-line method (1) Prepare the journal entry to record 2020 dopreciation (2) Show how the truck would be reported in the December 31, 2020, balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts