Question: Maybe this one is better. -4- C ollect and evaluate the data about stock performance of the assigned company for the last one year. (totally

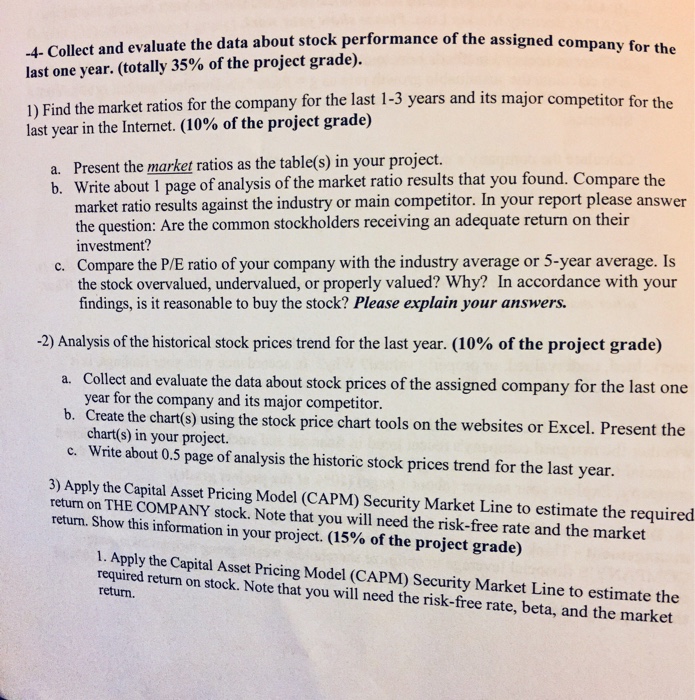

-4- C ollect and evaluate the data about stock performance of the assigned company for the last one year. (totally 35% of the project grade). 1) Find the market ratios for the company for the last 1-3 years and its major competitor for the last year in the Internet. (10% of the project grade) a. Present the market ratios as the table(s) in your project. b. Write about 1 page of analysis of the market ratio results that you found. Compare the market ratio results against the industry or main competitor. In your report please answer the question: Are the common stockholders receiving an adequate return on their investment? Compare the P/E ratio of your company with the industry average or 5-year average. Is the stock overvalued, undervalued, or properly valued? Why? In accordance with your findings, is it reasonable to buy the stock? Please explain your answers. c. 2) Analysis of the historical stock prices trend for the last year. (10% of the project grade) a. Collect and evaluate the data about stock prices of the assigned company for the last one year for the company and its major competitor. b. Create the chartis) using the stock price chart tools on the websites or Excel. Present the chart(s) in your project. c. Write about 0.5 page of analysis the historic stock prices trend for the last year. 3) Apply the Capital Asset Pricing Model (CAPM) Security Market Line to estimate the required return on THE COMPANY stock. Note that you will need the risk-free rate and the market return. Show this information in your project. (15% of the project grade) 1. Apply the Capital Asset Pricing Model (CAPM) Security Market Line to estimate the required return on stock. Note that you will need the risk-free rate, beta, and the market return. -4- C ollect and evaluate the data about stock performance of the assigned company for the last one year. (totally 35% of the project grade). 1) Find the market ratios for the company for the last 1-3 years and its major competitor for the last year in the Internet. (10% of the project grade) a. Present the market ratios as the table(s) in your project. b. Write about 1 page of analysis of the market ratio results that you found. Compare the market ratio results against the industry or main competitor. In your report please answer the question: Are the common stockholders receiving an adequate return on their investment? Compare the P/E ratio of your company with the industry average or 5-year average. Is the stock overvalued, undervalued, or properly valued? Why? In accordance with your findings, is it reasonable to buy the stock? Please explain your answers. c. 2) Analysis of the historical stock prices trend for the last year. (10% of the project grade) a. Collect and evaluate the data about stock prices of the assigned company for the last one year for the company and its major competitor. b. Create the chartis) using the stock price chart tools on the websites or Excel. Present the chart(s) in your project. c. Write about 0.5 page of analysis the historic stock prices trend for the last year. 3) Apply the Capital Asset Pricing Model (CAPM) Security Market Line to estimate the required return on THE COMPANY stock. Note that you will need the risk-free rate and the market return. Show this information in your project. (15% of the project grade) 1. Apply the Capital Asset Pricing Model (CAPM) Security Market Line to estimate the required return on stock. Note that you will need the risk-free rate, beta, and the market return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts