Question: MB 5 1 5 : Economic Theory and Application Problem Set 6 6 . 1 At Silverado Golf Club, the demand for rounds of golf

MB : Economic Theory and Application

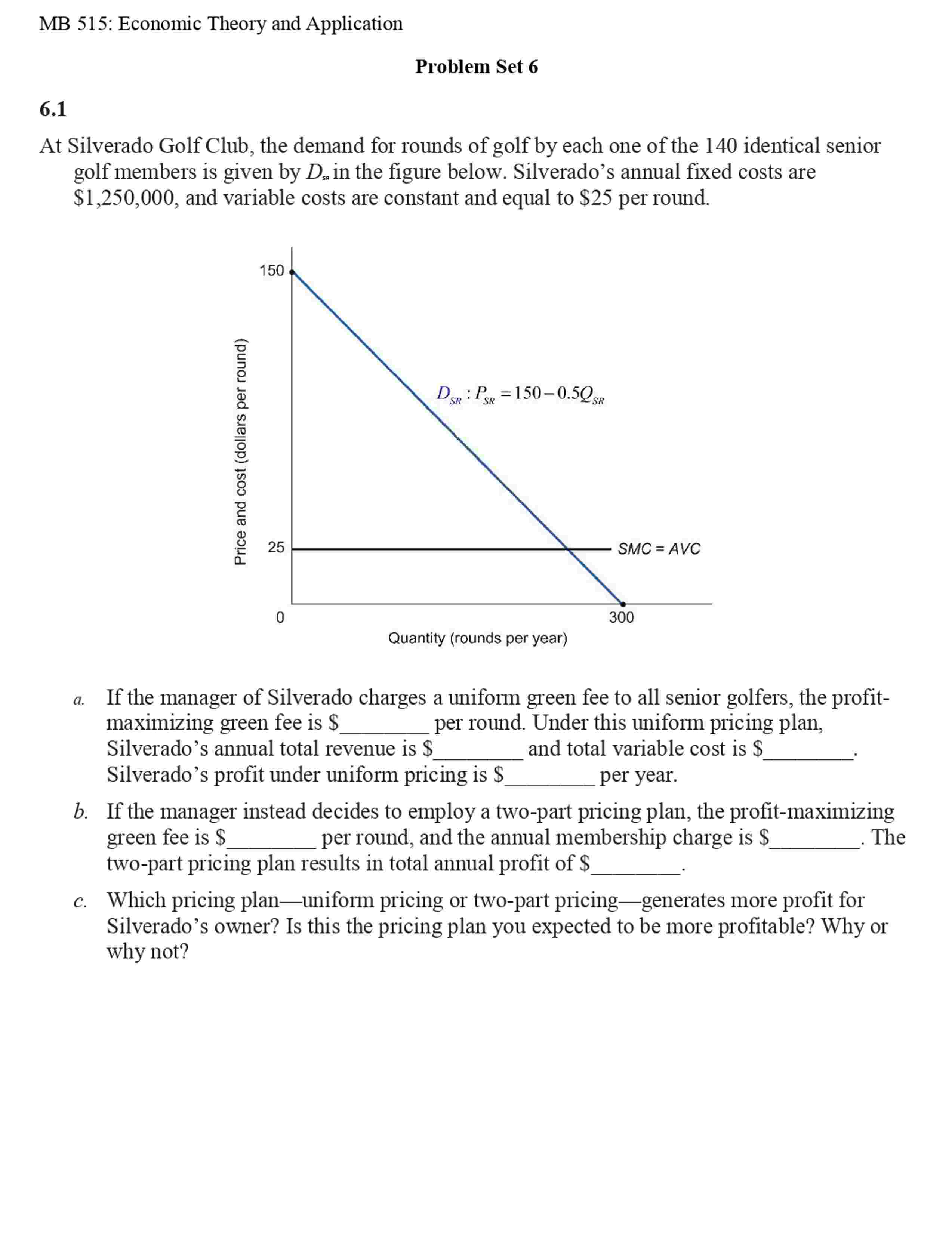

Problem Set

At Silverado Golf Club, the demand for rounds of golf by each one of the identical senior golf members is given by Dmathrmsp in the figure below. Silverado's annual fixed costs are $ and variable costs are constant and equal to $ per round.

a If the manager of Silverado charges a uniform green fee to all senior golfers, the profitmaximizing green fee is $ per round. Under this uniform pricing plan, Silverado's annual total revenue is $ and total variable cost is S Silverado's profit under uniform pricing is $ per year.

b If the manager instead decides to employ a twopart pricing plan, the profitmaximizing green fee is $ per round, and the annual membership charge is $ The twopart pricing plan results in total annual profit of $

c Which pricing planuniform pricing or twopart pricinggenerates more profit for Silverado's owner? Is this the pricing plan you expected to be more profitable? Why or why not?

Suppose Silverado Golf Club in question also has a second group of identical golfers, weekend players, who wish to play at the club. The demand for rounds of golf by each one of the identical weekend golfers is given by Dtext m in the figure below. Assume the same cost structure as given in question The manager designs an optimal twopart pricing plan for these two groups of golfers.

a The optimal green fee to set for each round of golf is $

b The optimal annual membership charge is $ for senior golfers and $ for weekend golfers.

c Under this twopart pricing plan, Silverado's annual profit is $

A manager faces two separate markets and decides to pricediscriminate.

The estimated demand functions for the two markets are

beginarrayl

Q P

Q P

endarray

The longrun marginal cost is estimated to be

L M C Q

a How many units should the manager produce and sell?

b How should the manager allocate the profitmaximizing output between the two markets?

c What prices should the manager charge in the two markets?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock