Question: MBA 212 Midterm Study Guide 1. Understand how WACC should be used for project evaluation. 2. Understand how the present value interest factor (PVIF) affects

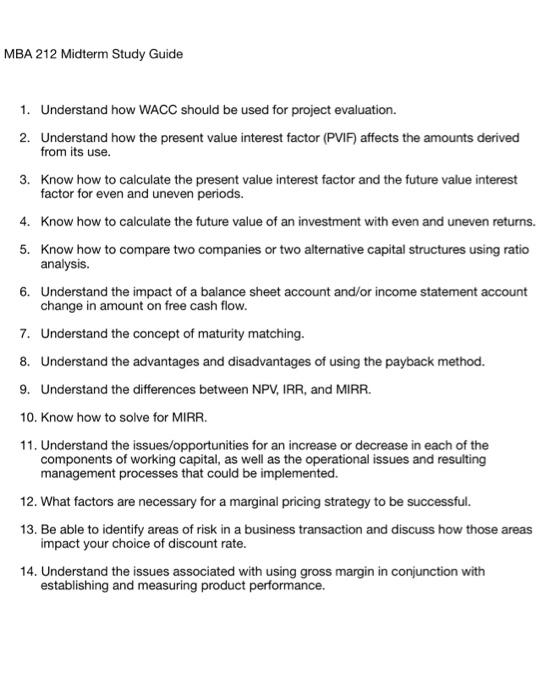

MBA 212 Midterm Study Guide 1. Understand how WACC should be used for project evaluation. 2. Understand how the present value interest factor (PVIF) affects the amounts derived from its use. 3. Know how to calculate the present value interest factor and the future value interest factor for even and uneven periods. 4. Know how to calculate the future value of an investment with even and uneven returns. 5. Know how to compare two companies or two alternative capital structures using ratio analysis. 6. Understand the impact of a balance sheet account and/or income statement account change in amount on free cash flow. 7. Understand the concept of maturity matching. 8. Understand the advantages and disadvantages of using the payback method. 9. Understand the differences between NPV, IRR, and MIRR. 10. Know how to solve for MIRR. 11. Understand the issues/opportunities for an increase or decrease in each of the components of working capital, as well as the operational issues and resulting management processes that could be implemented. 12. What factors are necessary for a marginal pricing strategy to be successful. 13. Be able to identify areas of risk in a business transaction and discuss how those areas impact your choice of discount rate. 14. Understand the issues associated with using gross margin in conjunction with establishing and measuring product performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts