Question: (mba 5220) please type the answers answer question 3 Case Study 5 SECURED SHORT-TERM FINANCING LAVELY CLOTHING COMPANY Aber rapid business growth in recent you

(mba 5220) please type the answers

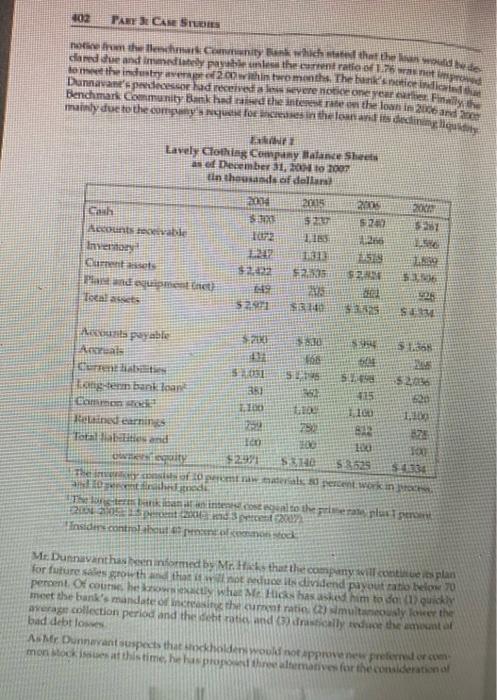

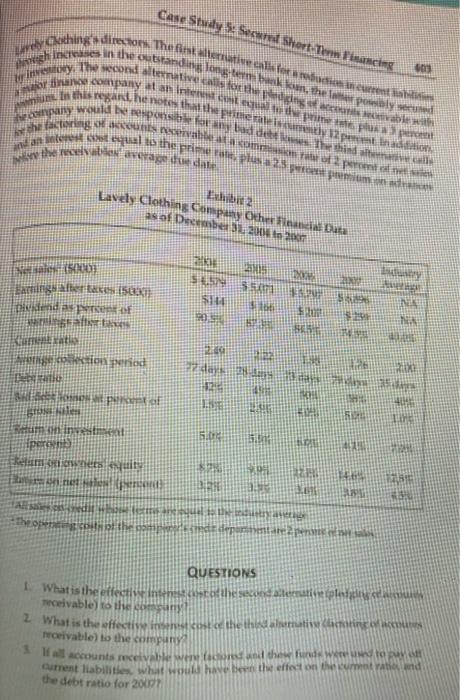

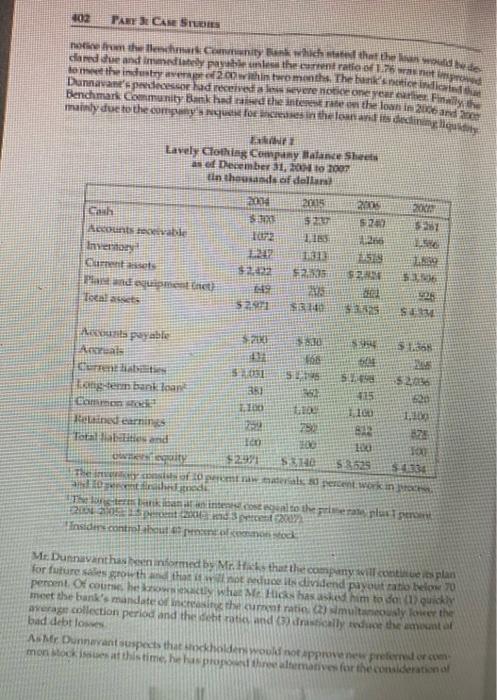

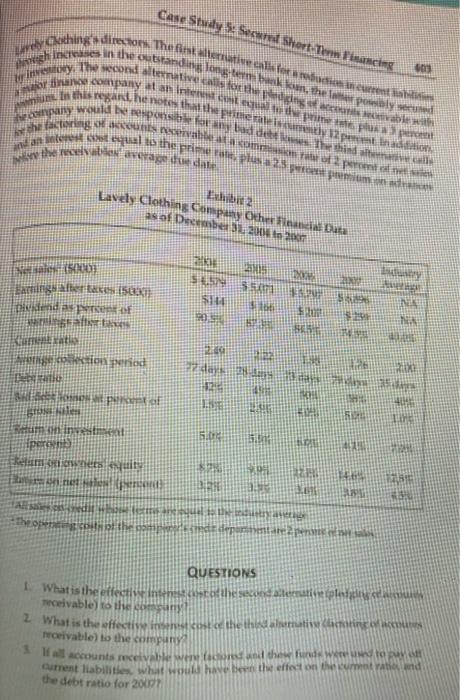

Case Study 5 SECURED SHORT-TERM FINANCING LAVELY CLOTHING COMPANY Aber rapid business growth in recent you the Lovely Ching Company in January anticipated further stalinis sales. Despite good prethe company esperienced a shortage of cash and has found it necess from the Benchmark Community Tank to 5520.000 in laty 2007 Label Tom normed about his fin's ability to raise the found out of capital to finance future growth in sales. While Me Hicks has been treated as a profeed customer of the to inclong-term what From 2004 about 20 customers Benchmark Community Bank Debra Knindon ve president and loan oficer at the be showed some signs of considerable displeasure at the rest meeting The Lavely Clothing Company located in Richmond, is a man of sportswear and swimsuits for men women and juniors The company rolul 2004 Mr Hicks purposely restricted sales te corporated in 198 ustnew years, however, he did notice aderided increase Richmond are. During the the.company's sales grew rapidly and Mr Hicks to pany festenough to keep up with demand. The company and the comme department stores and specialty shops) throughout the heastern United States Baguald Dunavant, the newly appointed to president of finance has been pondering the short-term financial problems of the company. Before Me Dansavant took the job heknew that his predecesso had been fized for inept working apital management. In order to better understand this alleged ineptness, he decided to analyze the financial data listed in Exhibits 1 and 2 Mr. Dunnavant has noted that the company's net sales and earnings after taxes have Increased rapidly since 2004. This growth has been accompanied by comparable in creases in assets and liabilities. He found that while earnings Tates have continued to Improve, they were below industry standards for returns on investment and net sales Furthermore he observed that the company's return on we equity has been higher then the industry norm in 2007 simply because its debt ratio has increased steadily and has been consistently higher than the industry average, Me Dannavant was stunned by a number of additional findings. First, the current ratio bad dropped considerably to well below the industry average Second, bad debt low have expanded to four or five times the industry average. Third, the average collection Period has been more than twice the industry standard. Fourth, while the dividend as percent of earnings after takes has decided somewhat during recent years. It has been prosinately two times as much as the industry norm. Fifth, the company received a 02 PART Case SI notes from the Benchmus.Commity which both liguld write dared and immediately pays les reiting to meet the industry avere 200 twoments. The bank's netinde Dunavan's passoudreces a severen. Finally Benchmark Community Bank had sid the interest muinly due to the company's Aquest for increases in the low and is declining liquktbly Et Lavely Clothing Company Balance Sheet of December 31, 2 to 2007 tin thousands of dollar Tha the loan in 2016 and we 2014 3. 2015 $ 20 521 Cash Accounts receivable Inventory Cuentos Plant and eminet) Total assets 20 $20 2016 25 SER ET $ 13 25 12 521 Si 126 Su Apayable SI S. Ancrat ti Current 50131 SL 5 2036 Hangterm bant loan 35 35 25 Commen tu 11 1.100 Rined earning 150 BA Totes and HO EX ity $29 SH 53525 54134 The of operates 30 percent working 10 kan intense to the great place 2 De 20 Insiders.contml.bout rontotod Mt Dunavanthathenied by Mr. Hacks that the company will continue plan for future sales growth and that not reduce its dividend payout ratio how zo perent. Of course, he way what Hickshas asked him to do quickly meet the bank's mandate of increase the current ratio (2) simultaneously lower the average collection period and the entrati and drastically in the meter bad debt los A Me Dunavantsuspects that stockholders would not approprio com mon Mocks at this time, has proposte alternatives for the considerational Case Study Secured Short Term Financing 103 muren regard he note that nghines in the outstandsbankan, the power thing directions The first time in My second alternative clothed ordinand company at nie company would be respons the receivable vorage date an interesultatet med COM of concernal the factor Fas ad pret Exbibit Lavey Clothing Company Other Data as of December 2012 50001 SUS ty 5.5 ti MA Bantinghalter SERIE didas SE hafi Batis Action period tie Spiel zde 1. 4143 instal 5. 24 nette BRE D. . the portare QUESTIONS 1. What is the effectivenesot these cute plan receivable to the company 2 What is the effectii ce the thematian ceivable to the company If all accounts receive the fund te per current liabilitiwal w Benthe effect on mata the debt ratio for 2000

answer question 3

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock