Question: MBF 3C1 Culminating Assignment Part 1 - Loans & Credit 1. Go online and research at least 3 different credit cards. Al major financial institutions

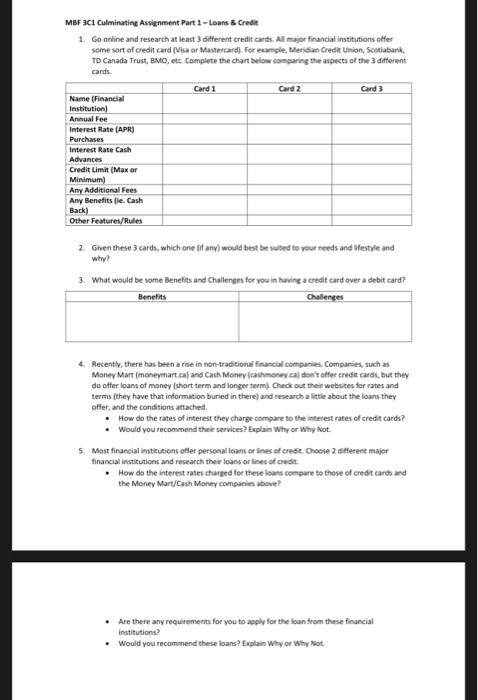

MBF 3C1 Culminating Assignment Part 1 - Loans & Credit 1. Go online and research at least 3 different credit cards. Al major financial institutions offer some sort of credit card Visa or Mastercard). For example, Merican Credit Union, Scotiabank, TD Canada Trust, BMO, etc. Complete the chart below comparing the aspects of the 3 different cards Card 1 Card 2 Card) Name (Financial Institution) Annual Fee Interest Rate (APR) Purchases Interest Rate Cash Advances Credit Limit (Max or Minimum) Any Additional Fees Any Benefits lie. Cash Back) Other Features/Rules 2. Given these 3 cards, which one of any) would best besuted to your needs and Westyle and why? 3. What would be some Benefits and Challenges for you in having a credit card over a debit card? Benefits Challenges 4. Recently, there has been a rise in non-traditional financial companies. Companies, such as Money Mart (moneymart.ca and Cash Money cashmoney don't offer credit cards, but they do offer loans of money short term and longer term. Check out their websites for rates and terms (they have that information buried in there) and research aletle about the loans they offer, and the conditions attached How do the rates of interest they charge compare to the interest rates of credit cards? Would you recommend their services? Explains why or Why Not 5. Most financial institutions ofler personal loans or ines of crede. Choose 2 different major financial institutions and research their loans or lines of credit How do the interest rates charged for these loans compare to those of credit cards and the Money Mart/Cash Money companies above? . Are there any requirements for you to apply for the loan from these financial institutions? . Would you recommend these loans? Explain Why or Why Not MBF 3C1 Culminating Assignment Part 1 - Loans & Credit 1. Go online and research at least 3 different credit cards. Al major financial institutions offer some sort of credit card Visa or Mastercard). For example, Merican Credit Union, Scotiabank, TD Canada Trust, BMO, etc. Complete the chart below comparing the aspects of the 3 different cards Card 1 Card 2 Card) Name (Financial Institution) Annual Fee Interest Rate (APR) Purchases Interest Rate Cash Advances Credit Limit (Max or Minimum) Any Additional Fees Any Benefits lie. Cash Back) Other Features/Rules 2. Given these 3 cards, which one of any) would best besuted to your needs and Westyle and why? 3. What would be some Benefits and Challenges for you in having a credit card over a debit card? Benefits Challenges 4. Recently, there has been a rise in non-traditional financial companies. Companies, such as Money Mart (moneymart.ca and Cash Money cashmoney don't offer credit cards, but they do offer loans of money short term and longer term. Check out their websites for rates and terms (they have that information buried in there) and research aletle about the loans they offer, and the conditions attached How do the rates of interest they charge compare to the interest rates of credit cards? Would you recommend their services? Explains why or Why Not 5. Most financial institutions ofler personal loans or ines of crede. Choose 2 different major financial institutions and research their loans or lines of credit How do the interest rates charged for these loans compare to those of credit cards and the Money Mart/Cash Money companies above? . Are there any requirements for you to apply for the loan from these financial institutions? . Would you recommend these loans? Explain Why or Why Not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts