Question: MBF3C (Gr.11 Math) UNIT 8: PERSONAL FINANCE (All about cheques accounts, savings accounts, investments, credit cards, obtaining vehicles, operating a vehicle) Some examples and formula

MBF3C (Gr.11 Math) UNIT 8: PERSONAL FINANCE (All about cheques accounts, savings accounts, investments, credit cards, obtaining vehicles, operating a vehicle) Some examples and formula provided that can be use, just choose formula that suits the question :)

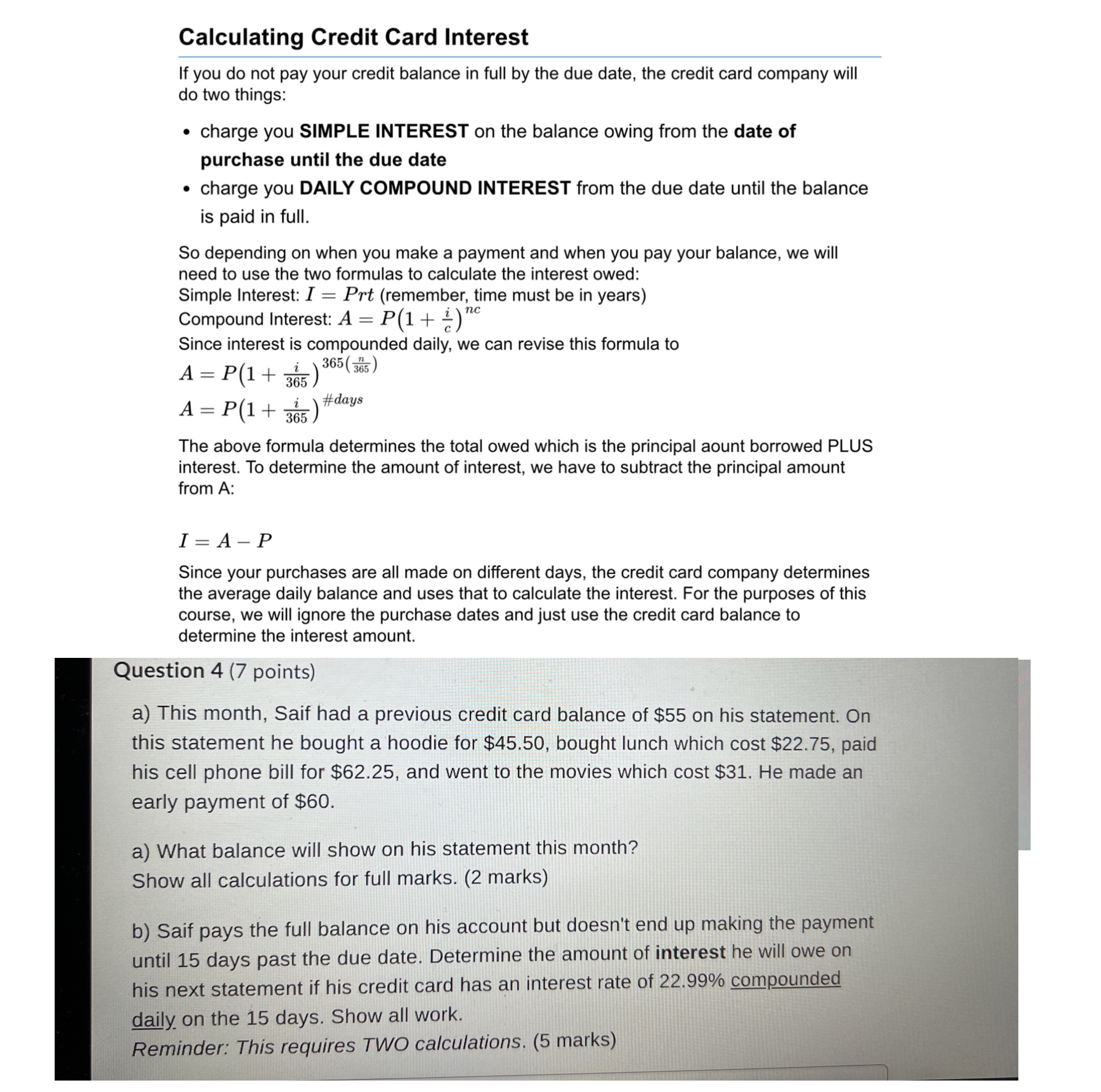

Calculating Credit Card Interest If you do not pay your credit balance in full by the due date, the credit card company will do two things: . charge you SIMPLE INTEREST on the balance owing from the date of purchase until the due date . charge you DAILY COMPOUND INTEREST from the due date until the balance is paid in full. So depending on when you make a payment and when you pay your balance, we will need to use the two formulas to calculate the interest owed: Simple Interest: I = Prt (remember, time must be in years) Compound Interest: A = P(1 + i ) nc Since interest is compounded daily, we can revise this formula to A = P(1 + 365 ) 365 (365 ) A = P(1 + 365) #days The above formula determines the total owed which is the principal aount borrowed PLUS interest. To determine the amount of interest, we have to subtract the principal amount from A: I = A-P Since your purchases are all made on different days, the credit card company determines the average daily balance and uses that to calculate the interest. For the purposes of this course, we will ignore the purchase dates and just use the credit card balance to determine the interest amount. Question 4 (7 points) a) This month, Saif had a previous credit card balance of $55 on his statement. On this statement he bought a hoodie for $45.50, bought lunch which cost $22.75, paid his cell phone bill for $62.25, and went to the movies which cost $31. He made an early payment of $60. a) What balance will show on his statement this month? Show all calculations for full marks. (2 marks) b) Saif pays the full balance on his account but doesn't end up making the payment until 15 days past the due date. Determine the amount of interest he will owe on his next statement if his credit card has an interest rate of 22.99% compounded daily on the 15 days. Show all work. Reminder: This requires TWO calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts