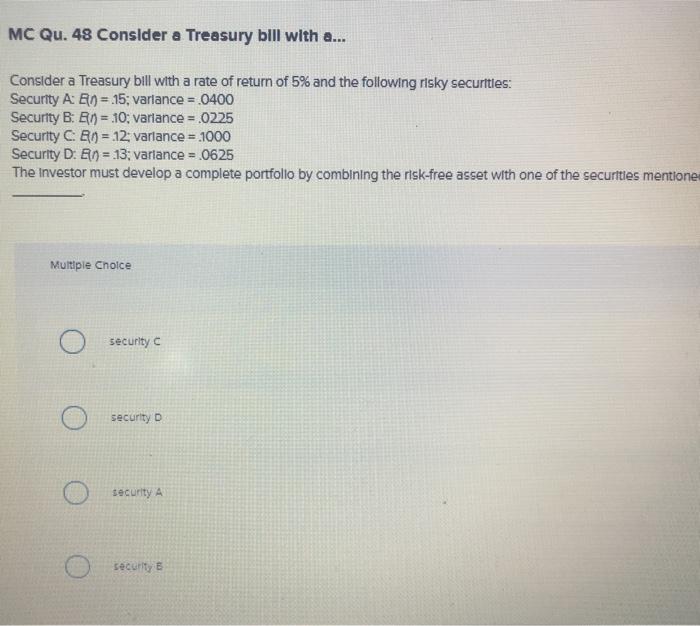

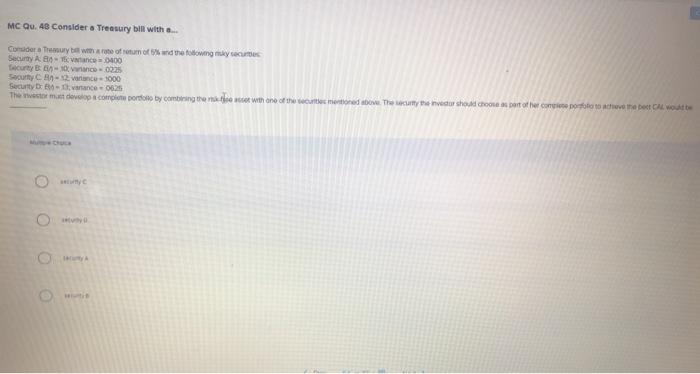

Question: MC Qu. 48 Consider a Treasury bill with a... Consider a Treasury bill with a rate of return of 5% and the following risky securities:

MC Qu. 48 Consider a Treasury bill with a... Consider a Treasury bill with a rate of return of 5% and the following risky securities: Security A: E9 = 15; varlance = 0400 Security B: En = 10; variance = .0225 Security C A9 = 12; variance = 1000 Security D: En = 13; variance = 20625 The Investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentione Multiple Choice security C security D Security A security MC Qu. 48 Consider a Treasury bill with ... Consider Tramury best wrote of return of the following my tec Secury Ace 0400 cy.co.0225 Soy CR-12. variance 1000 Security Dance0625 The master mat develop a completo portfolio by combining the nationiter with one of the screen nortones tow. The skulle vader should choona na part of her complete portate to co habet Close

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts