Question: MC Qu. 54 Kelso Electric is debating between a leveraged and an unleveraged capital structure.... Kelso Electric is debating between a leveraged and an unleveraged

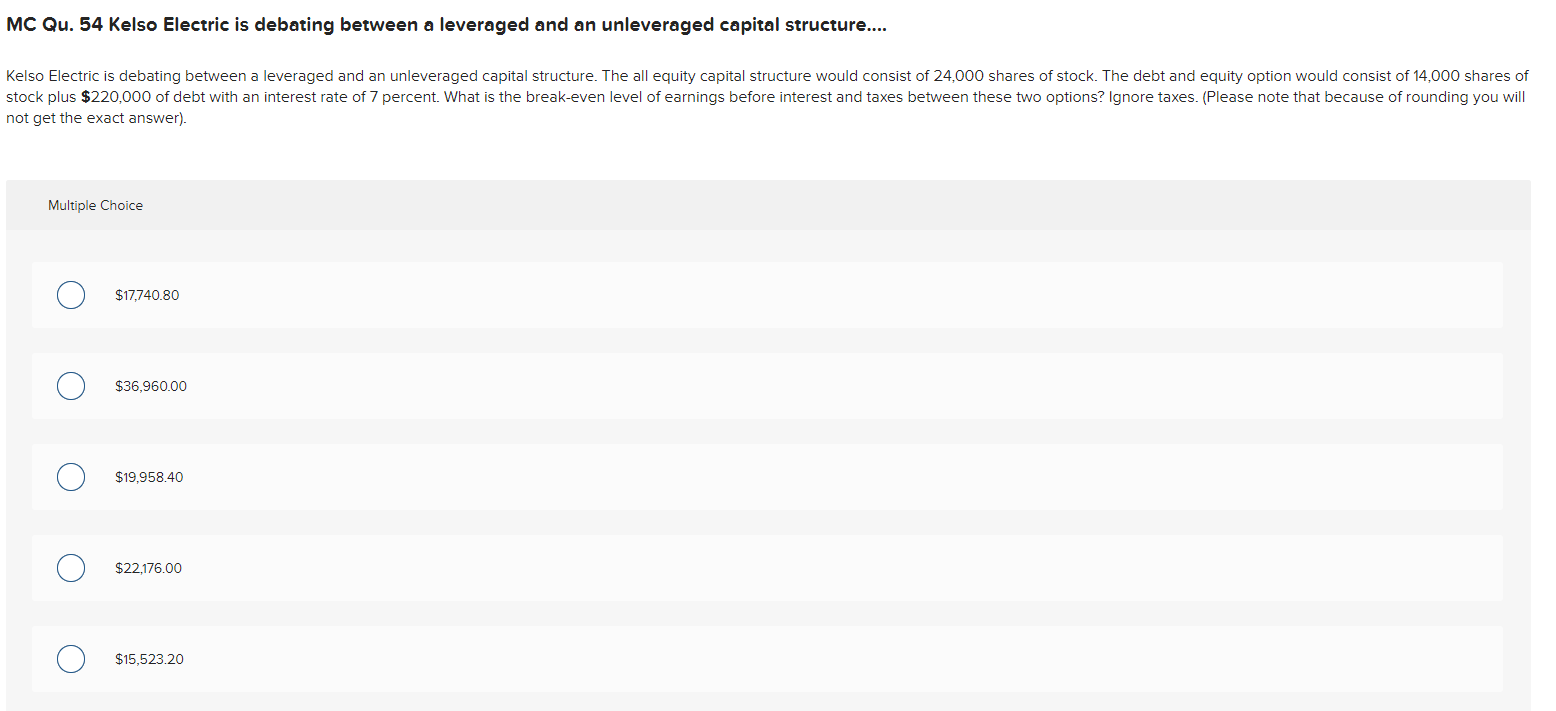

MC Qu. 54 Kelso Electric is debating between a leveraged and an unleveraged capital structure.... Kelso Electric is debating between a leveraged and an unleveraged capital structure. The all equity capital structure would consist of 24,000 shares of stock. The debt and equity option would consist of 14,000 shares of stock plus $220,000 of debt with an interest rate of 7 percent. What is the break-even level of earnings before interest and taxes between these two options? Ignore taxes. (Please note that because of rounding you will not get the exact answer). Multiple Choice $17,740.80 $36,960.00 $19,958.40 o $22,176.00 O $15,523.20

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock