Question: MC09. 9&10 Question 9 1 pts Stag Corp. will pay dividends of $4.75,$5.25,$5.75, and $7 for the next four years. Thereafter, the company expects 7

MC09. 9&10

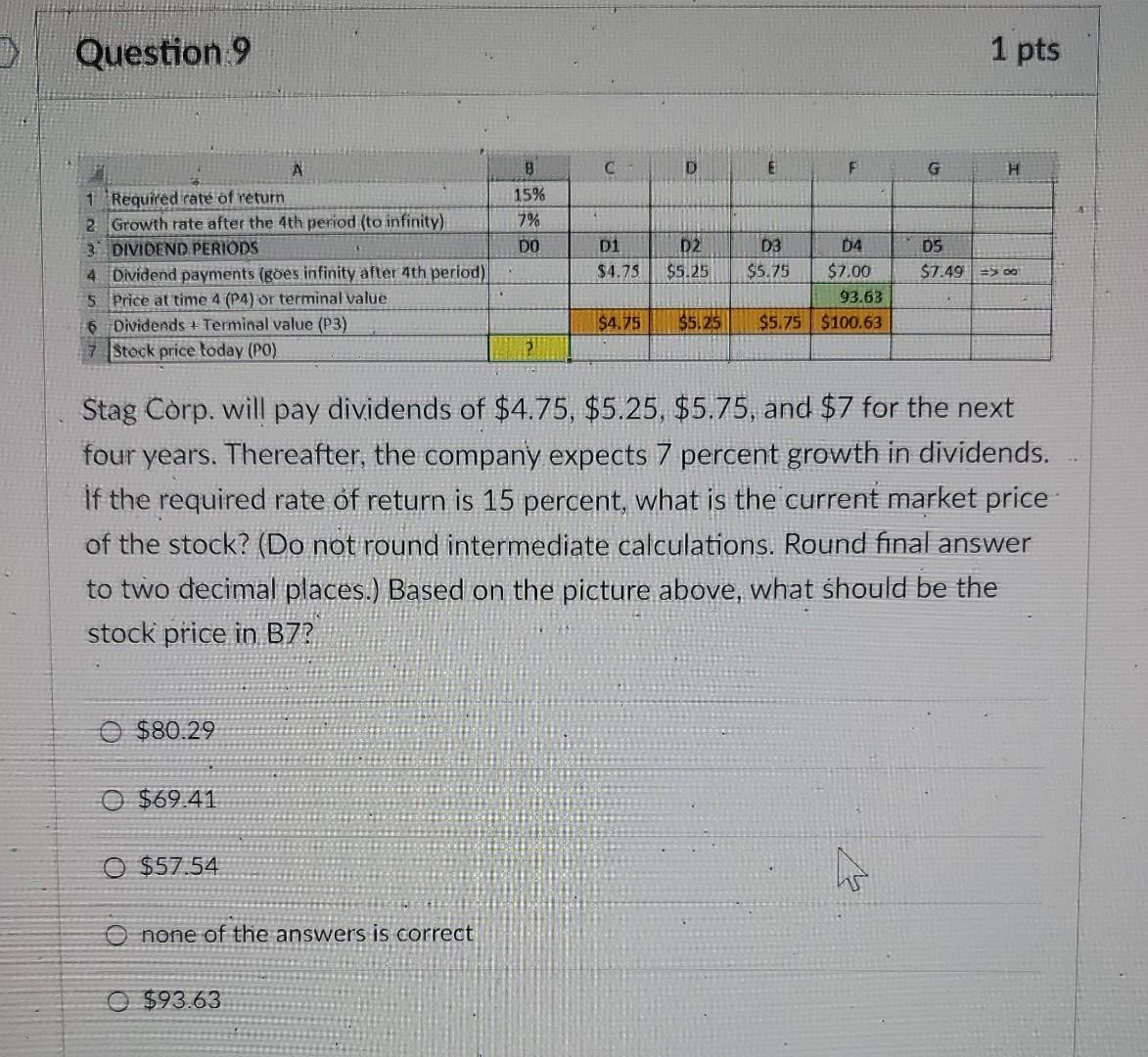

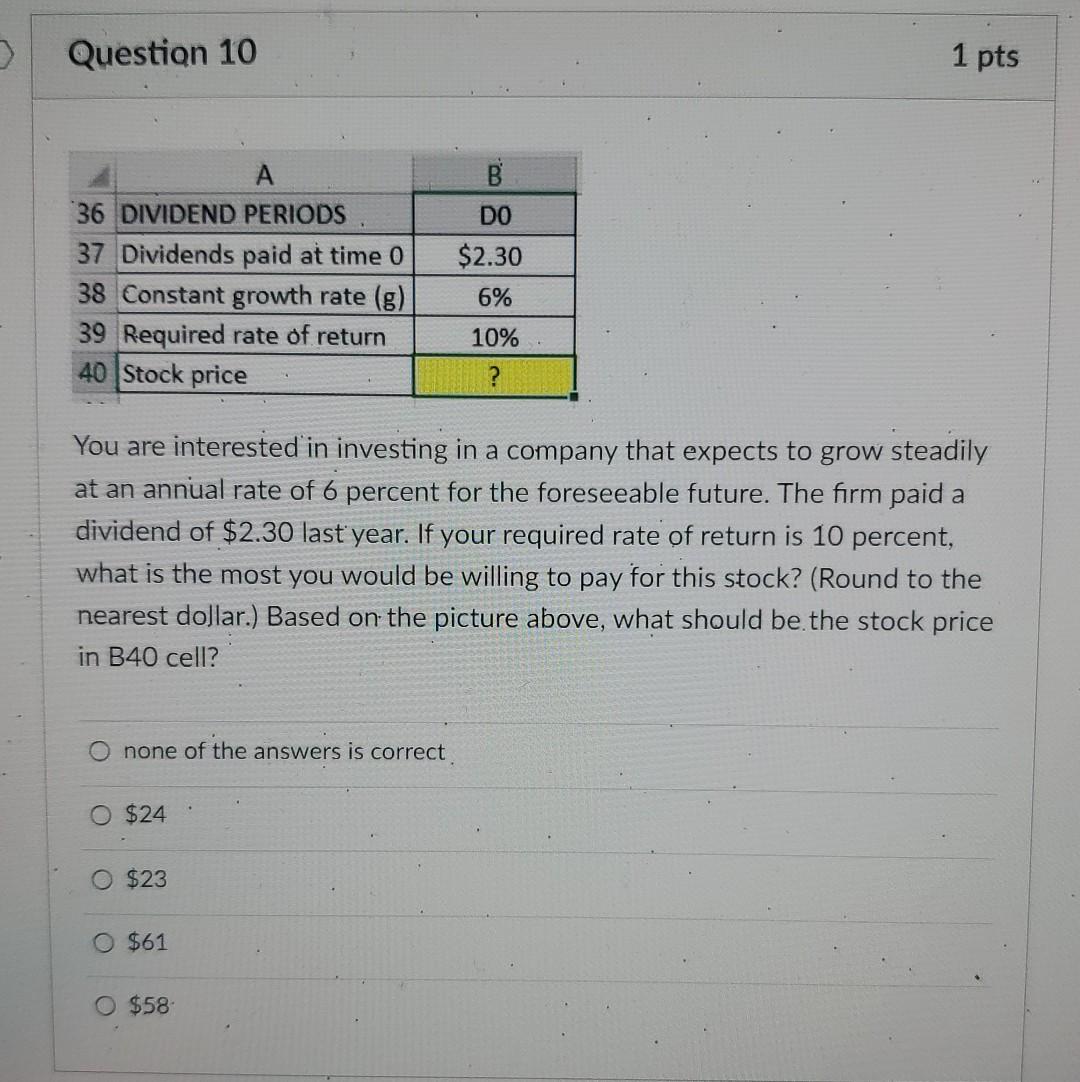

Question 9 1 pts Stag Corp. will pay dividends of $4.75,$5.25,$5.75, and $7 for the next four years. Thereafter, the company expects 7 percent growth in dividends. If the required rate of return is 15 percent, what is the current market priceof the stock? (Do not round intermediate calculations. Round final answer to two decimal places.) Based on the picture above, what should be the stock price in B7 ? $80.29 $69.41 $57.54 none of the answers is correct $93.63 Question 10 1pts You are interested in investing in a company that expects to grow steadily at an annual rate of 6 percent for the foreseeable future. The firm paid a dividend of $2.30 last year. If your required rate of return is 10 percent, what is the most you would be willing to pay for this stock? (Round to the nearest dollar.) Based on the picture above, what should be. the stock price in B40 cell? none of the answers is correct $24 $23 $61 $58

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts