Question: MC10. 7&8 Question 7 1 pts Giant Electronics is issuing 20-year bonds that will pay coupons semiannually. The coupon rate on this bond is 7.8

MC10. 7&8

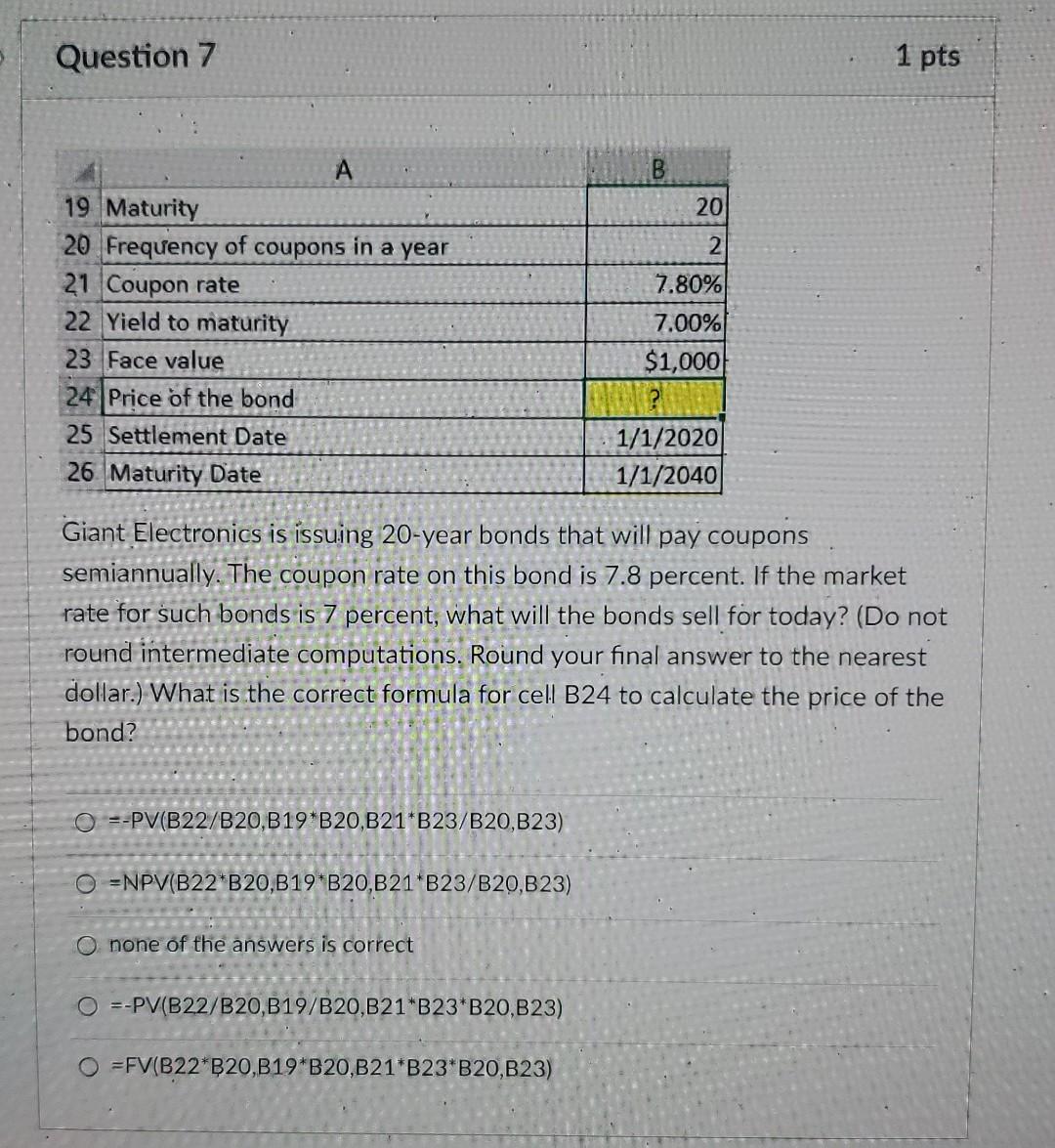

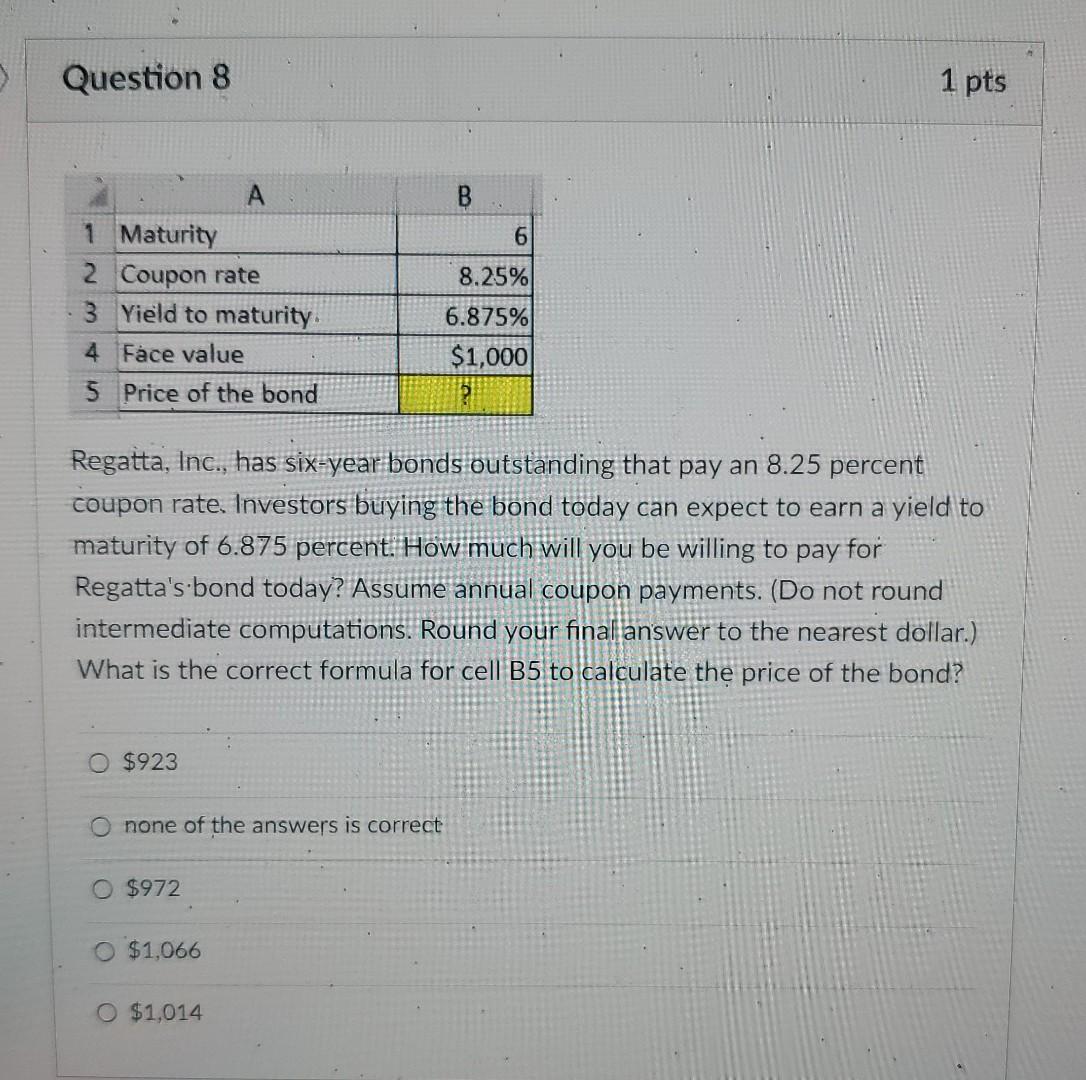

Question 7 1 pts Giant Electronics is issuing 20-year bonds that will pay coupons semiannually. The coupon rate on this bond is 7.8 percent. If the market rate for such bonds is 7 percent, what will the bonds sell for today? (Do not round intermediate computations, Round your final answer to the nearest dollar.) What is the correct formula for cell B24 to calculate the price of the bond? =PV(B22/B20,B19B20,B21B23/B20,B23)=NPV(B22B20,B19B20,B21B23/B20,B23) none of the answers is correct =PV(B22/B20,B19/B20,B21B23B20,B23)=FV(B22B20,B19B20,B21B23B20,B23) Question 8 1 pts Regatta, Inc., has six-year-bonds outstanding that pay an 8.25 percent coupon rate. Investors buying the bond today can expect to earn a yield to maturity of 6.875 percent: How much will you be willing to pay for Regatta's.bond today? Assume annual coupon payments. (Do not round intermediate computations. Round your finalianswer to the nearest dollar.) What is the correct formula for cell B5 to calculate the price of the bond? $923 none of the answers is correct $972 $1,066 $1,014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts