Question: MCHUZA M ME Reader ROWE + a A15-11 Convertible Debt; Investor Option versus Conversion Mandatory: AMC Ltd. issued five-year, 5% bonds for their par value

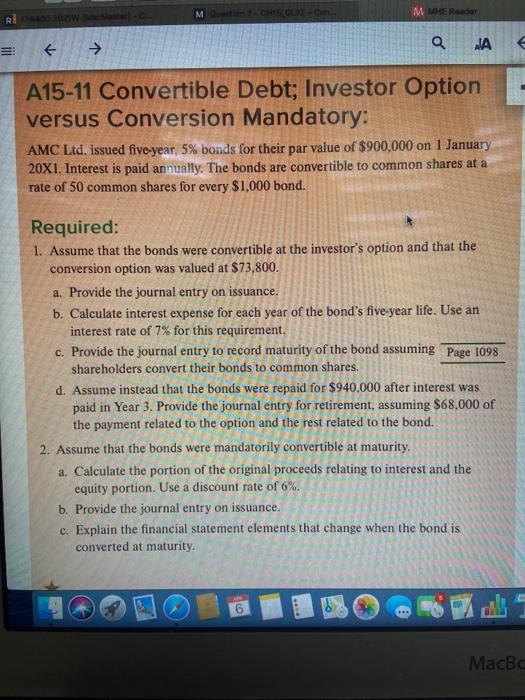

MCHUZA M ME Reader ROWE + a A15-11 Convertible Debt; Investor Option versus Conversion Mandatory: AMC Ltd. issued five-year, 5% bonds for their par value of $900,000 on 1 January 20X1. Interest is paid annually. The bonds are convertible to common shares at a rate of 50 common shares for every $1,000 bond. Required: 1. Assume that the bonds were convertible at the investor's option and that the conversion option was valued at $73,800. a. Provide the journal entry on issuance. b. Calculate interest expense for each year of the bond's five-year life. Use an interest rate of 7% for this requirement. c. Provide the journal entry to record maturity of the bond assuming Page 1098 shareholders convert their bonds to common shares. d. Assume instead that the bonds were repaid for $940,000 after interest was paid in Year 3. Provide the journal entry for retirement, assuming $68.000 of the payment related to the option and the rest related to the bond. 2. Assume that the bonds were mandatorily convertible at maturity. a. Calculate the portion of the original proceeds relating to interest and the equity portion. Use a discount rate of 6%. b. Provide the journal entry on issuance. c. Explain the financial statement elements that change when the bond is converted at maturity 6 MacBc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts