Question: mck . Profitability Index method : Assuming the projects are indivisible and there is no alternative use of unutilized amount, S. Ltd. is advised to

mck

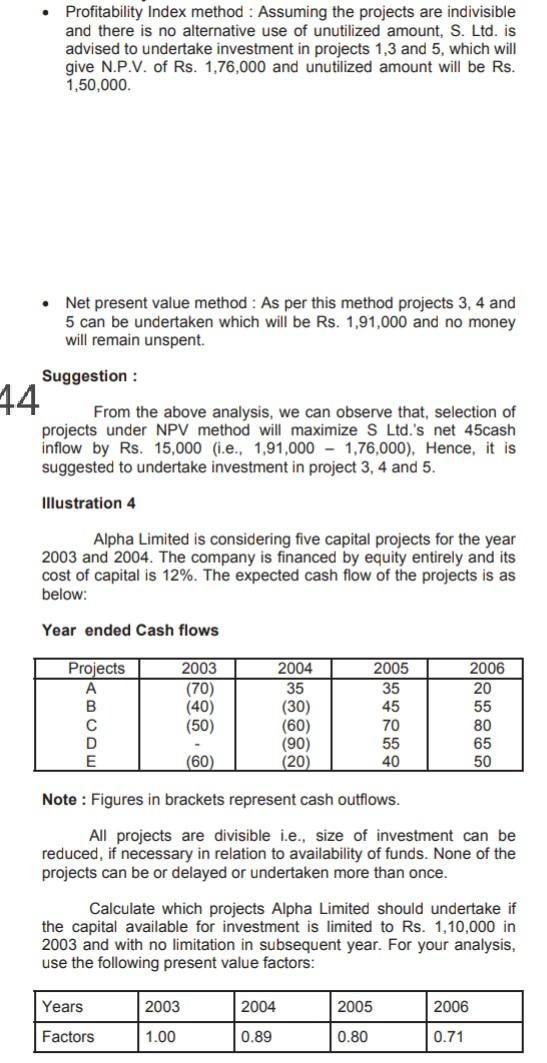

. Profitability Index method : Assuming the projects are indivisible and there is no alternative use of unutilized amount, S. Ltd. is advised to undertake investment in projects 1,3 and 5, which will give N.P.V. of Rs. 1,76,000 and unutilized amount will be Rs. 1,50,000. Net present value method : As per this method projects 3, 4 and 5 can be undertaken which will be Rs. 1,91,000 and no money will remain unspent. Suggestion : 44 From the above analysis, we can observe that, selection of projects under NPV method will maximize S Ltd.'s net 45cash inflow by Rs. 15,000 (i.e., 1,91,000 - 1,76,000). Hence, it is suggested to undertake investment in project 3, 4 and 5. Illustration 4 Alpha Limited is considering five capital projects for the year 2003 and 2004. The company is financed by equity entirely and its cost of capital is 12%. The expected cash flow of the projects is as below: Year ended Cash flows Projects B D E 2003 (70) (40) (50) 2004 35 (30) (60) (90) (20) 2005 35 45 70 55 40 2006 20 55 80 65 50 (60) Note: Figures in brackets represent cash outflows. All projects are divisible i.e., size of investment can be reduced, if necessary in relation to availability of funds. None of the projects can be or delayed or undertaken more than once. Calculate which projects Alpha Limited should undertake if the capital available for investment is limited to Rs. 1,10,000 in 2003 and with no limitation in subsequent year. For your analysis, use the following present value factors: Years 2003 2004 2005 2006 Factors 1.00 0.89 0.80 0.71 . Profitability Index method : Assuming the projects are indivisible and there is no alternative use of unutilized amount, S. Ltd. is advised to undertake investment in projects 1,3 and 5, which will give N.P.V. of Rs. 1,76,000 and unutilized amount will be Rs. 1,50,000. Net present value method : As per this method projects 3, 4 and 5 can be undertaken which will be Rs. 1,91,000 and no money will remain unspent. Suggestion : 44 From the above analysis, we can observe that, selection of projects under NPV method will maximize S Ltd.'s net 45cash inflow by Rs. 15,000 (i.e., 1,91,000 - 1,76,000). Hence, it is suggested to undertake investment in project 3, 4 and 5. Illustration 4 Alpha Limited is considering five capital projects for the year 2003 and 2004. The company is financed by equity entirely and its cost of capital is 12%. The expected cash flow of the projects is as below: Year ended Cash flows Projects B D E 2003 (70) (40) (50) 2004 35 (30) (60) (90) (20) 2005 35 45 70 55 40 2006 20 55 80 65 50 (60) Note: Figures in brackets represent cash outflows. All projects are divisible i.e., size of investment can be reduced, if necessary in relation to availability of funds. None of the projects can be or delayed or undertaken more than once. Calculate which projects Alpha Limited should undertake if the capital available for investment is limited to Rs. 1,10,000 in 2003 and with no limitation in subsequent year. For your analysis, use the following present value factors: Years 2003 2004 2005 2006 Factors 1.00 0.89 0.80 0.71Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock