Question: Me CTRW | | | | un 3 of 2 4 Concepts completed Multiple Choice Question John Smith works 4 0 hours for ABC Corp.

Me

CTRW

un

of Concepts completed

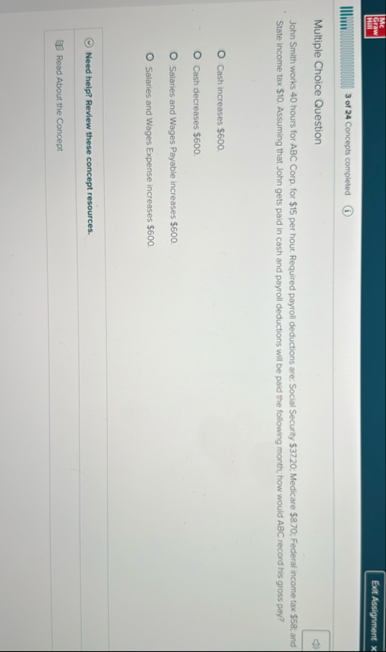

Multiple Choice Question

John Smith works hours for ABC Corp. for $ per hour. Required payroll deductions are: Social Securly $; Medicare $; Federal income tax $; and State income tax $ Assuming that John gets paid in cash and payroll deductions will be paid the following month, how would ABC record his gross pay?

Cash increases $

Cash decreases $

Salanes and Wages Payable increases $

Salaries and Wages Expense increases $

Need help? Review these concept resources.

Read About the Concept

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock