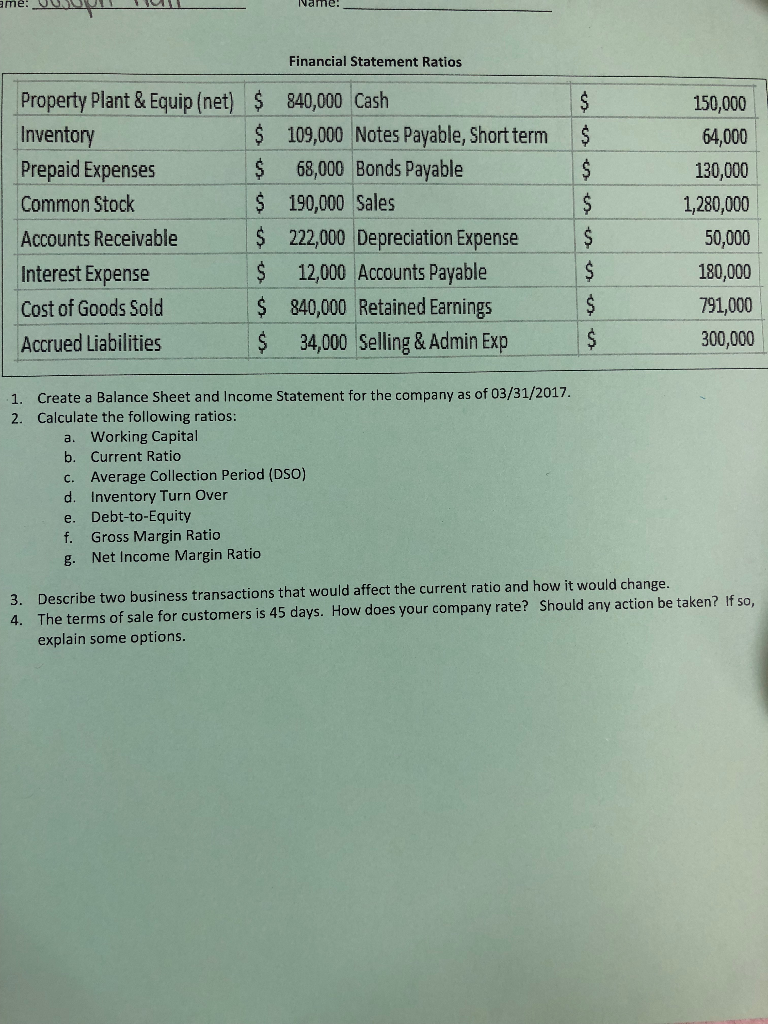

Question: me Name. Financial Statement Ratios $ $ 109,000 Notes Payable, Short term $ Property Plant & Equip (net) Inventory Prepaid Expenses Common Stock Accounts Receivable

me Name. Financial Statement Ratios $ $ 109,000 Notes Payable, Short term $ Property Plant & Equip (net) Inventory Prepaid Expenses Common Stock Accounts Receivable Interest Expense Cost of Goods Sold Accrued Liabilities 840,000 Cash 150,000 64,000 130,000 1,280,000 50,000 180,000 791,000 300,000 68,000 Bonds Payable 190,000 Sales 222,000 Depreciation Expense$ S 12,000 Accounts Payable $ 840,000 Retained Earnings 34,000 Selling &Admin Exp 1. 2. Create a Balance Sheet and Income Statement for the company as of 03/31/2017. Calculate the following ratios: a. Working Capital b. Current Ratio c. Average Collection Period (DSO) d. Inventory Turn Over e. Debt-to-Equity f. Gross Margin Ratio g. Net Income Margin Ratio Describe two business transactions that would affect the current ratio and how it would change. The terms of sale for customers is 45 days. How does your company rate? Should any action be taken? if so, explain some options. 3. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts