Question: Me Ocean is considering two new projects, Project X and Project Y. Each investment needs an equipment investment of $40,000. Each project will last for

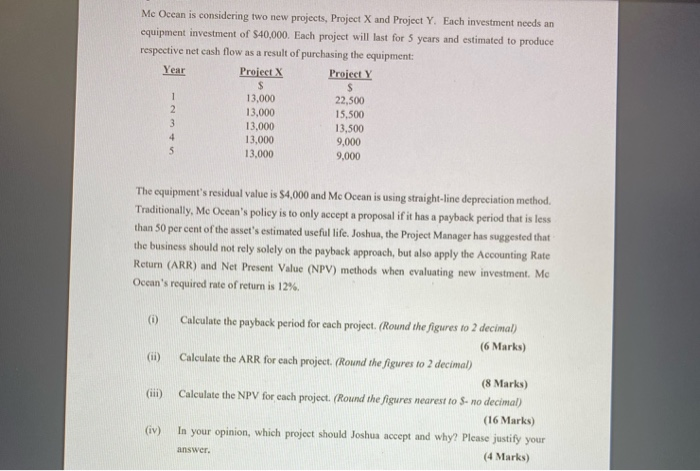

Me Ocean is considering two new projects, Project X and Project Y. Each investment needs an equipment investment of $40,000. Each project will last for 5 years and estimated to produce respective net cash flow as a result of purchasing the equipment: Year Project X Project S $ 13,000 22,500 2 13,000 15,500 3 13,000 13,500 4 13,000 9,000 5 13,000 9,000 1 The equipment's residual value is $4,000 and Mc Ocean is using straight-line depreciation method. Traditionally, Mc Ocean's policy is to only accept a proposal if it has a payback period that is less than 50 per cent of the asset's estimated useful life. Joshua, the Project Manager has suggested that the business should not rely solely on the payback approach, but also apply the Accounting Rate Return (ARR) and Net Present Value (NPV) methods when evaluating new investment. Me Ocean's required rate of return is 12%. (i) (ii) Calculate the payback period for each project. (Round the figures to 2 decimal) (6 Marks) Calculate the ARR for each project. (Round the figures to 2 decimal) (8 Marks) Calculate the NPV for each project. (Round the figures nearest to S- no decimal) (16 Marks) In your opinion, which project should Joshua accept and why? Please justify your (4 Marks) (iii) (iv)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts