Question: Meadow Company wants to invest its net profits of $123,000 for 3 years in either a credit union or a local bank. The credit union

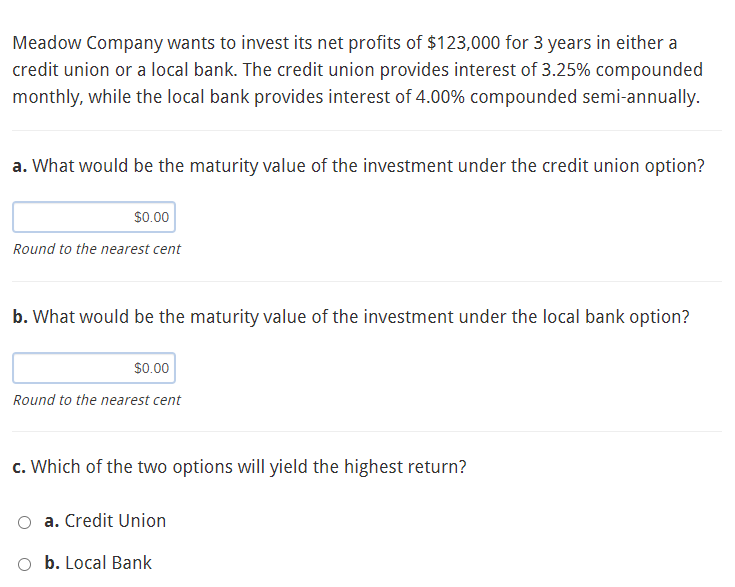

Meadow Company wants to invest its net profits of $123,000 for 3 years in either a credit union or a local bank. The credit union provides interest of 3.25% compounded monthly, while the local bank provides interest of 4.00% compounded semi-annually. a. What would be the maturity value of the investment under the credit union option? $0.00 Round to the nearest cent b. What would be the maturity value of the investment under the local bank option? $0.00 Round to the nearest cent c. Which of the two options will yield the highest return? a. Credit Union b. Local Bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts