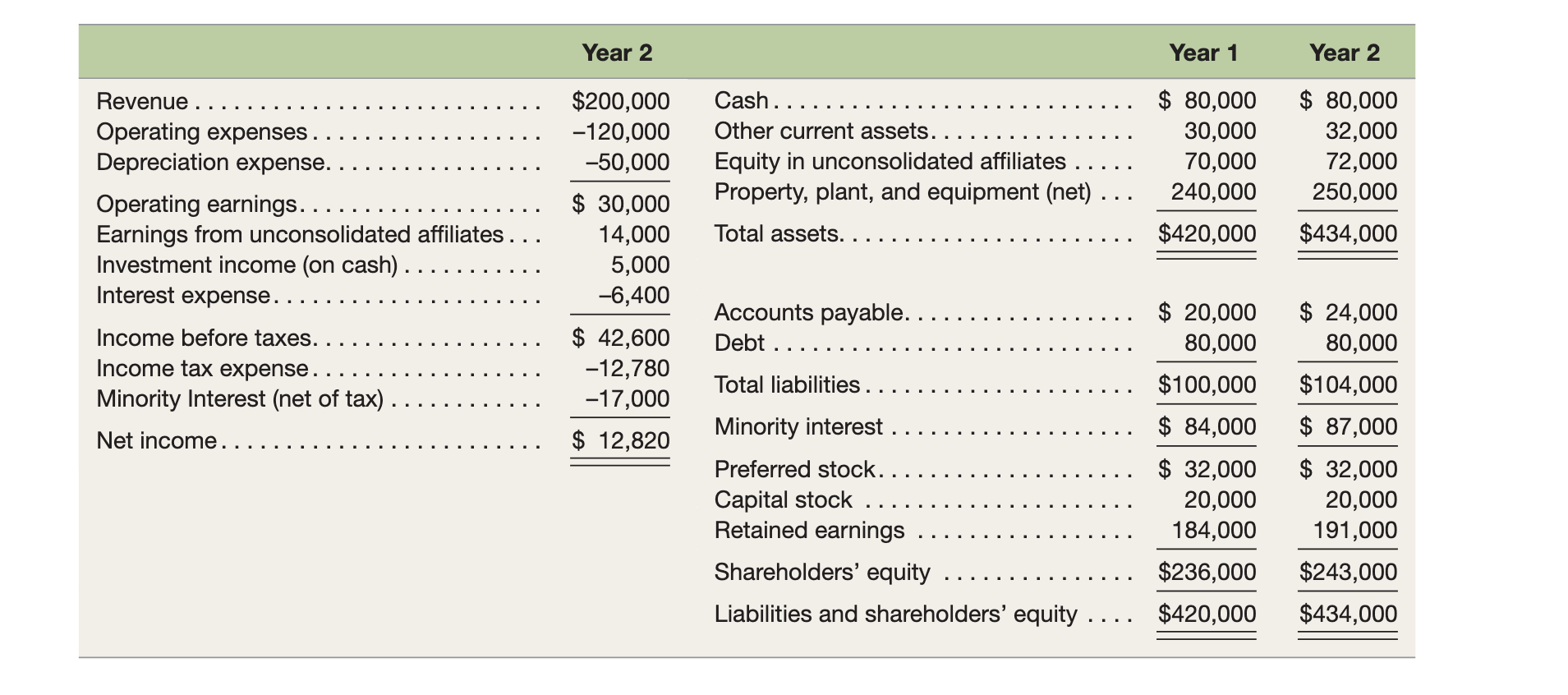

Question: Measuring Market Multiple Numerators Multiple Company: Below, we present an income statement and balance sheet for the Multiple Company. The companys debt and preferred stock

Measuring Market Multiple NumeratorsMultiple Company: Below, we present an income statement and balance sheet for the Multiple Company. The companys debt and preferred stock are recorded on the balance sheet at par value. The debt and preferred stock are currently trading at 95% and 105% of their respective par values. The companys debt has an 8% interest rate and the dividend yield for its preferred stock is 9%. The company has 50,000 shares of outstanding stock trading at $8 per share. The company also has 10,000 employee stock options outstanding that the company valued at $3 per option. The companys income tax rate on all income is 30%. Calculate the companys enterprise value and equity value in order to measure the companys market multiples as discussed in the previous sections of this chapter. Calculate the companys enterprise value to unlevered earnings, EBIT, EBITDA, revenue, and P/E multiples without making any adjustments to the income statement. Hint: Measure the unlevered earnings as net income plus after-tax inter- est expense and measure EBIT as net income plus interest expense plus income tax expense.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts