Question: Measuring standalone Risk using realized data 3. Measuring standalone risk using realized (historical) data Returns earned over a given time period are called realized returns.

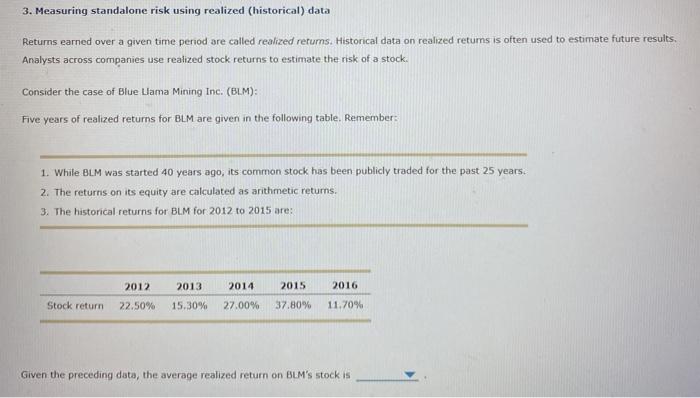

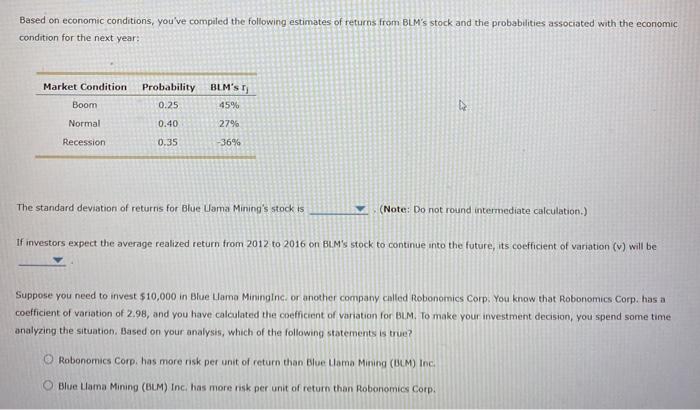

3. Measuring standalone risk using realized (historical) data Returns earned over a given time period are called realized returns. Historical data on realized returns is often used to estimate future results. Analysts across companies use realized stock returns to estimate the risk of a stock. Consider the case of Blue Lama Mining Inc. (BLM): Five years of realized returns for BLM are given in the following table. Remember: 1. While BLM was started 40 years ago, its common stock has been publicly traded for the past 25 years. 2. The returns on its equity are calculated as arithmetic returns. 3. The historical returns for BLM for 2012 to 2015 are: 2012 2013 2014 2015 2016 Stock return 22.50% 15.30% 27.00% 37.80% 11.70% Given the preceding data, the average realized return on BLM's stock is Based on economic conditions, you've compiled the following estimates of returns from BLM's stock and the probabilities associated with the economic condition for the next year: Market Condition Probability 0.25 BLM'ST) 45% Boom Normal 0.40 27% Recession 0.35 -36% The standard deviation of returns for Blue Lama Mining's stock is (Note: Do not round intermediate calculation.) If investors expect the average realized return from 2012 to 2016 on BLM's stock to continue into the future, its coefficient of variation (V) will be Suppose you need to invest $10,000 in Blue Llama Mininging, or another company called Robonomics Corp. You know that Robonomics Corp. has a coefficient of variation of 2.98, and you have calculated the coefficient of variation for BLM. To make your investment decision, you spend some time analyzing the situation. Based on your analysis, which of the following statements is true? Robonomics Corp, has more risk per unit of return than Blue Llama Mining (UUM) Inc Blue Llama Mining (BLM) Inc. has more risk per unit of return than Robonomics Corp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts