Question: Media Arts Components (MAC) is considering a new production machine. The new machine will cost $250,000, has a 5 year expected life and salvage value

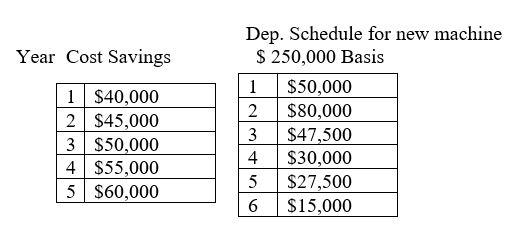

Media Arts Components (MAC) is considering a new production machine. The new machine will cost $250,000, has a 5 year expected life and salvage value of $25,000. The new machine is expected to result in operating efficiencies which will save $40,000 annually. It will be depreciated using the MACRS method with a 5 year asset class. The machine will require new inventory of $20,000 to support the machine.

MAC is in a high risk industry and has a cost of capital of 15%. The company pays 40% of its income in taxes.

- Determine the initial cash outlay if the new machine is purchased.

b. Determine the incremental operating cash flows in years 1-5.

| OCF1

|

|

| OCF2

|

|

| OCF3

|

|

| OCF4

|

|

| OCF5

|

|

c. What is the terminal (non-operating) cash flow in year 5?

d. Should the new machine be purchased? Explain your rationale. (NPV)

Year Cost Savings 1 $40,000 2 $45,000 3 $50,000 4 $55,000 5 $60,000 Dep. Schedule for new machine $ 250,000 Basis 1 $50,000 2 $80,000 3 $47,500 4 $30,000 5 $27,500 6 $15,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts