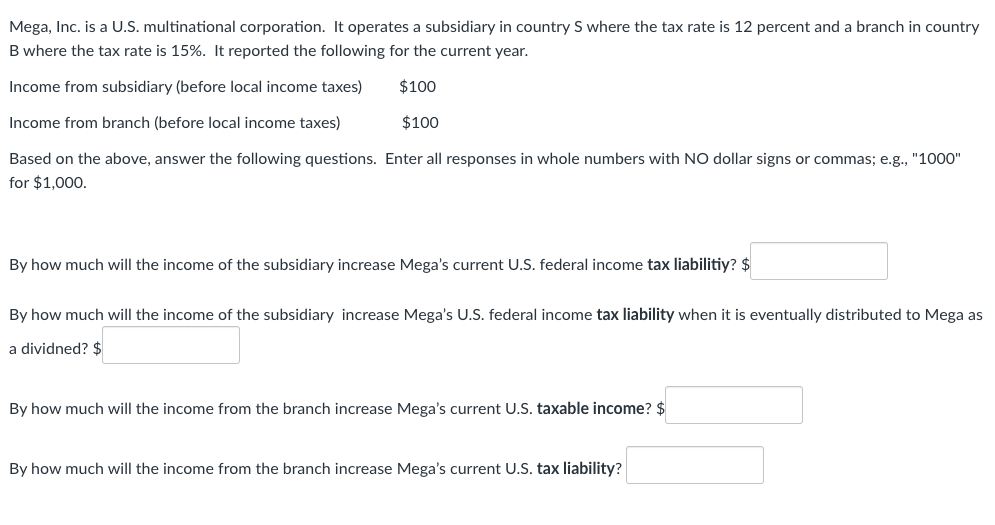

Question: Mega, Inc. is a U . S . multinational corporation. It operates a subsidiary in country S where the tax rate is 1 2 percent

Mega, Inc. is a US multinational corporation. It operates a subsidiary in country where the tax rate is percent and a branch in country

B where the tax rate is It reported the following for the current year.

Based on the above, answer the following questions. Enter all responses in whole numbers with NO dollar signs or commas; eg

for $

By how much will the income of the subsidiary increase Mega's current US federal income tax liabilitiy? $

By how much will the income of the subsidiary increase Mega's US federal income tax liability when it is eventually distributed to Mega as

a dividned? $

By how much will the income from the branch increase Mega's current US taxable income? $

By how much will the income from the branch increase Mega's current US tax liability?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock