Question: Megastar software recently developed new spreadsheet software, Ad-soon, which it intends to market by mail through ads in computer magazines. Just prior introducing Ad-soon, Megastar

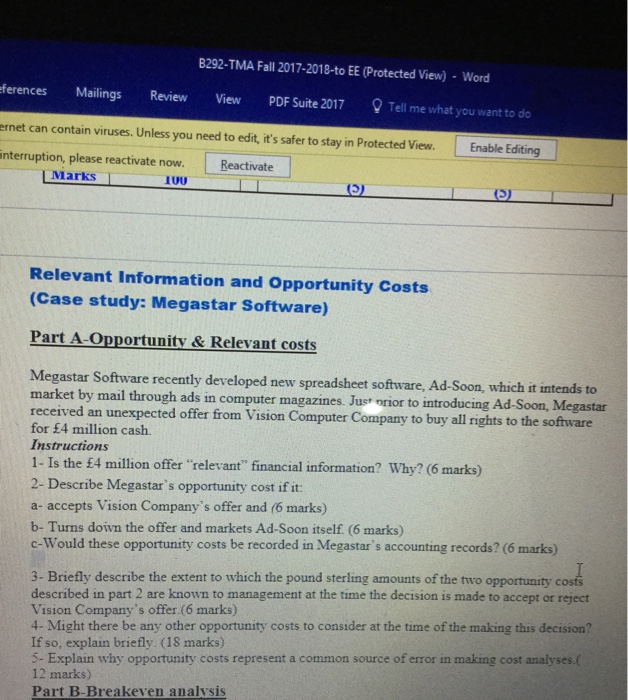

B292-TMA Fall 2017-2018-to EE (Protected View) - Word ferences Mailings Review View PDF Suite 2017 Tell me what you want to do ernet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing interruption, please reactivate now Reactivate LMarks IUU Relevant Information and Opportunity Costs (Case study: Megastar Software) Part A-Opportunity & Relevant costs Software recently developed new spreadsheet software, Ad-Soon, which it intends to introducing Ad-Soon, Megastar market by mail through ads in computer magazines. Just orior to received an unexpected offer from Vision Computer Company to buy all rights to the software for 4 million cash. Instructions 1- Is the 4 million offer "relevant" financial information? Why? (6 marks) 2- Describe Megastar's opportunity cost if it a- accepts Vision Company's offer and (6 marks) b- Turns doivn the offer and markets Ad-Soon itself (6 marks) c-Would these opportunity costs be recorded in Megastar's accounting records? (6 marks) 3- Briefly describe the extent to which the pound sterling amounts of the two opportunity described in part 2 are known to management at the time the decision is made to accept or reject Vision Company's offer.(6 marks) 4- Might there be any other opportunity costs to consider at the time of the making this decision? If so, explain briefly. (18 marks) 5- Explain why opportunity costs represent a common source of error in making cost analyses.( 12 marks) Part B-Breakeven analysis costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts