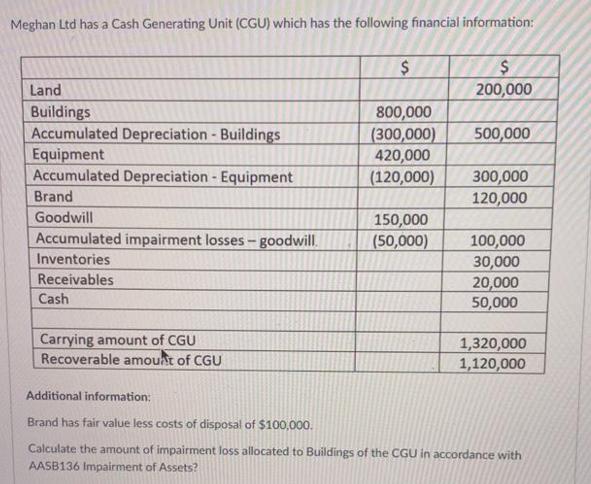

Question: Meghan Ltd has a Cash Generating Unit (CGU) which has the following financial information: $ 200,000 Land Buildings Accumulated Depreciation - Buildings Equipment Accumulated

Meghan Ltd has a Cash Generating Unit (CGU) which has the following financial information: $ 200,000 Land Buildings Accumulated Depreciation - Buildings Equipment Accumulated Depreciation - Equipment Brand Goodwill Accumulated impairment losses-goodwill. Inventories Receivables Cash Carrying amount of CGU Recoverable amount of CGU $ 800,000 (300,000) 420,000 (120,000) 150,000 (50,000) 500,000 300,000 120,000 100,000 30,000 20,000 50,000 1,320,000 1,120,000 Additional information: Brand has fair value less costs of disposal of $100,000. Calculate the amount of impairment loss allocated to Buildings of the CGU in accordance with AASB136 Impairment of Assets?

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

The answer provided below has been developed in a clear step step mannerStep 1 The amount of impairm... View full answer

Get step-by-step solutions from verified subject matter experts