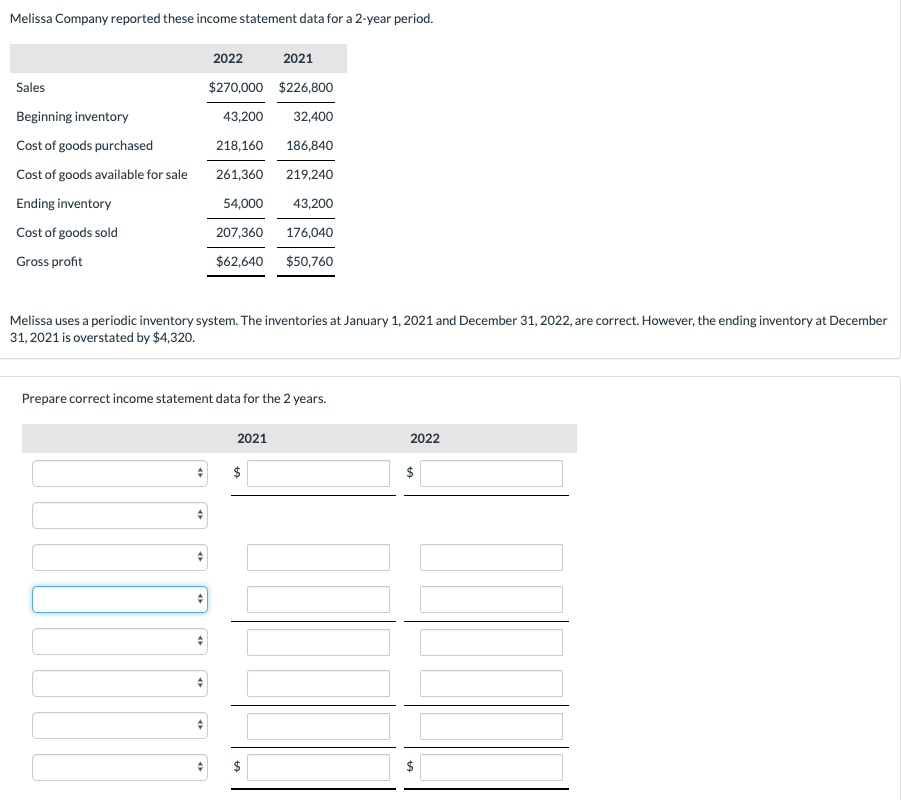

Question: Melissa Company reported these income statement data for a 2-year period. 2022 2021 $270,000 $226,800 Sales Beginning inventory 43,200 32,400 Cost of goods purchased 218,160

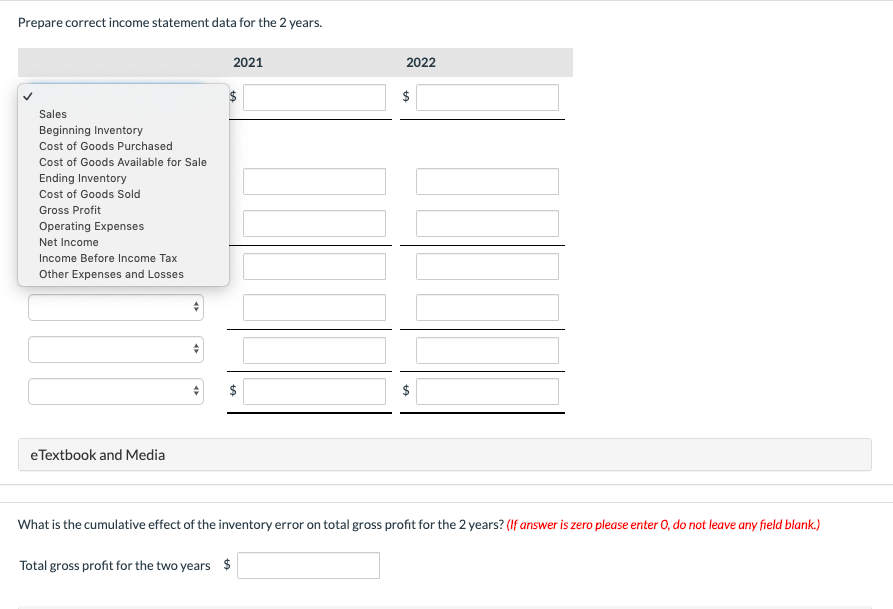

Melissa Company reported these income statement data for a 2-year period. 2022 2021 $270,000 $226,800 Sales Beginning inventory 43,200 32,400 Cost of goods purchased 218,160 186,840 Cost of goods available for sale 261,360 219,240 Ending inventory 54,000 43,200 Cost of goods sold 207,360 176,040 $62,640 $50,760 Gross profit Melissa uses a periodic inventory system. The inventories at January 1, 2021 and December 31, 2022, are correct. However, the ending inventory at December 31, 2021 is overstated by $4,320. Prepare correct income statement data for the 2 years 2021 2022 tA tA Prepare correct income statement data for the 2 years 2021 2022 $ Sales Beginning Inventory Cost of Goods Purchased Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Net Income Income Before Income Tax Other Expenses and Losses eTextbook and Media What is the cumulative effect of the inventory error on total gross profit for the 2 years? (If answer is zero please enter 0, do not leave any field blank.) $ Total gross profit for the two years tA tA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts