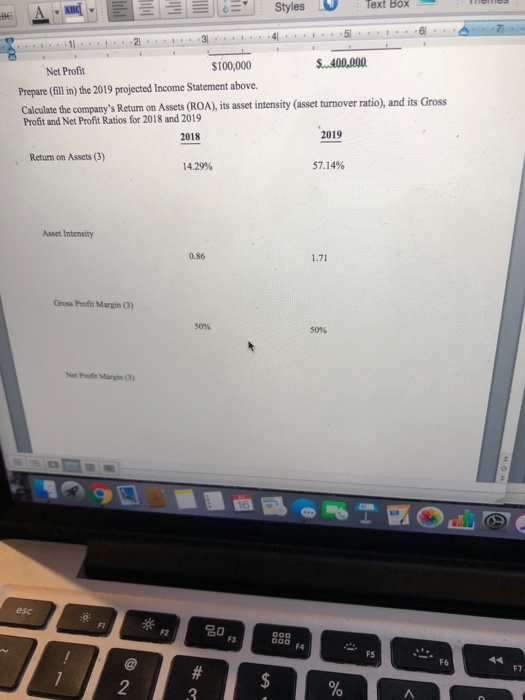

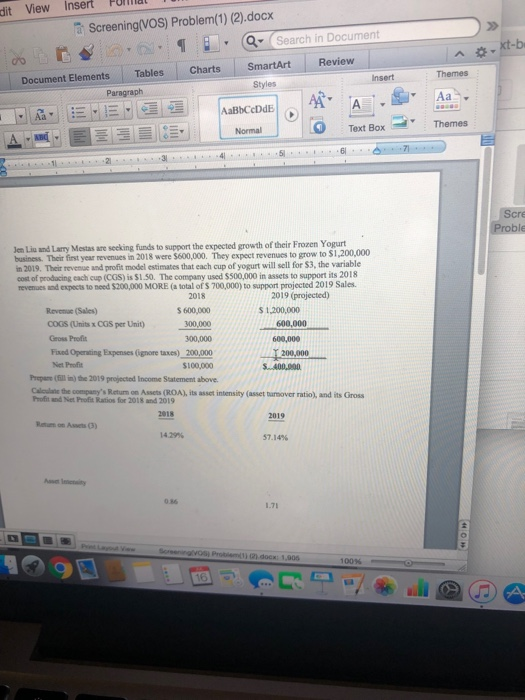

Question: Mell 7 . - E EEE Styles - Text Box .6 .5 1 . .4 2 .3 S.400.000 Net Profit $100,000 Prepare (fill in the

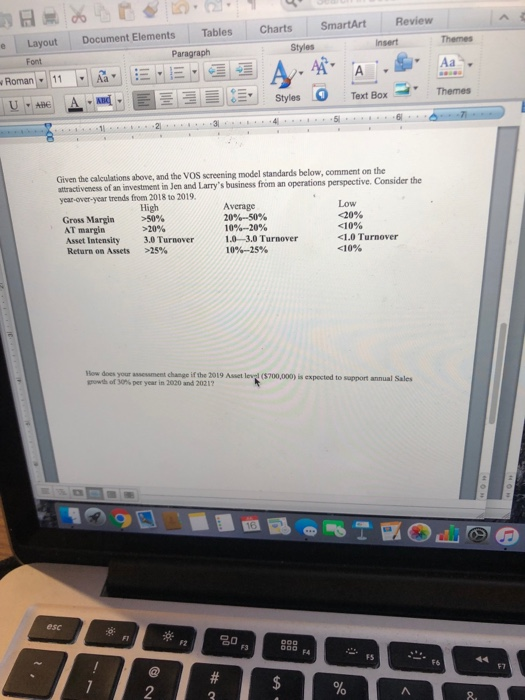

Mell 7 . - E EEE Styles - Text Box .6 .5 1 . .4 2 .3 S.400.000 Net Profit $100,000 Prepare (fill in the 2019 projected Income Statement above. Calculate the company's Retum on Assets (ROA), its asset intensity (asset turnover ratio), and its Gross Profit and Net Profit Ratios for 2018 and 2019 2018 2019 Retum on Assets (3) 14.29% 57.14% Asset Intensity 0.86 Gross Profit Margin (3) Net Pot Marin) Review Charts SmartArt Insert Themes Document Elements Tables Paragraph - Layout Font Roman - 11 U - ADE Styles A . A A Styles Text Box 1 Themes 71 . 5 .4 . 6 . 1 . 2 .3 Given the calculations above, and the VOS screening model standards below, comment on the attractiveness of an investment in Jen and Larry's business from an operations perspective. Consider the year-over-year trends from 2018 to 2019. High Average Low Gross Margin 20% 20%-50% >50% AT margin > 20% 25% 10%-25% 50% AT margin > 20% 25% 10%-25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts