Melvin is single, age 58. He eamed the following income this year: Salary Qualified dividend income...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

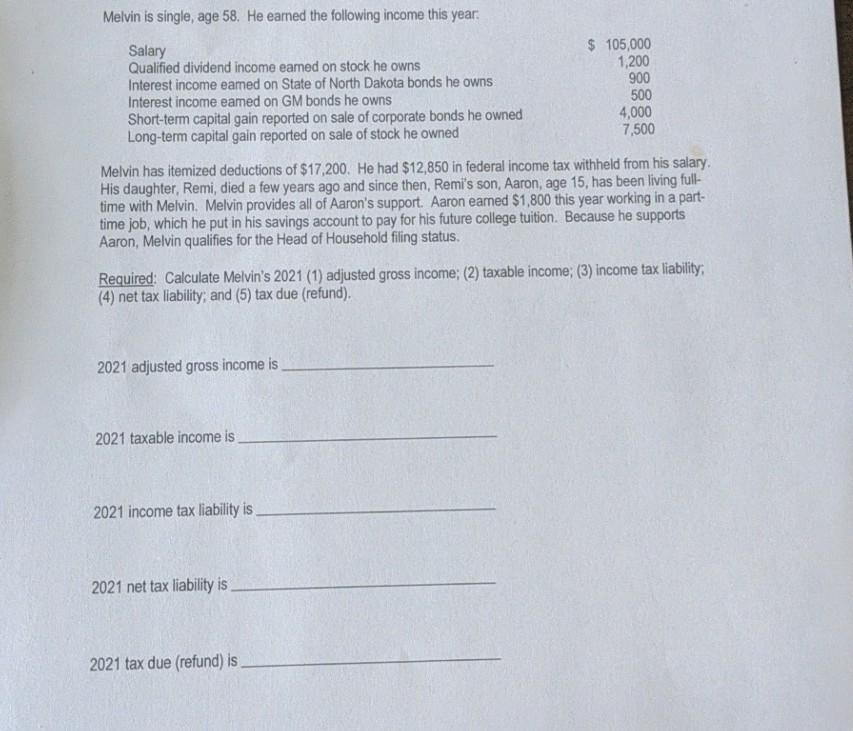

Melvin is single, age 58. He eamed the following income this year: Salary Qualified dividend income eamed on stock he owns Interest income eamed on State of North Dakota bonds he owns Interest income eamed on GM bonds he owns Short-term capital gain reported on sale of corporate bonds he owned Long-term capital gain reported on sale of stock he owned $ 105,000 1,200 900 500 4,000 7,500 Melvin has itemized deductions of $17,200. He had $12,850 in federal income tax withheld from his salary. His daughter, Remi, died a few years ago and since then, Remi's son, Aaron, age 15, has been living full- time with Melvin. Melvin provides all of Aaron's support. Aaron earned $1,800 this year working in a part- time job, which he put in his savings account to pay for his future college tuition. Because he supports Aaron, Melvin qualifies for the Head of Household filing status. Required: Calculate Melvin's 2021 (1) adjusted gross income; (2) taxable income; (3) income tax liability; (4) net tax liability; and (5) tax due (refund). 2021 adjusted gross income is 2021 taxable income is 2021 income tax liability is 2021 net tax liability is 2021 tax due (refund) is Melvin is single, age 58. He eamed the following income this year: Salary Qualified dividend income eamed on stock he owns Interest income eamed on State of North Dakota bonds he owns Interest income eamed on GM bonds he owns Short-term capital gain reported on sale of corporate bonds he owned Long-term capital gain reported on sale of stock he owned $ 105,000 1,200 900 500 4,000 7,500 Melvin has itemized deductions of $17,200. He had $12,850 in federal income tax withheld from his salary. His daughter, Remi, died a few years ago and since then, Remi's son, Aaron, age 15, has been living full- time with Melvin. Melvin provides all of Aaron's support. Aaron earned $1,800 this year working in a part- time job, which he put in his savings account to pay for his future college tuition. Because he supports Aaron, Melvin qualifies for the Head of Household filing status. Required: Calculate Melvin's 2021 (1) adjusted gross income; (2) taxable income; (3) income tax liability; (4) net tax liability; and (5) tax due (refund). 2021 adjusted gross income is 2021 taxable income is 2021 income tax liability is 2021 net tax liability is 2021 tax due (refund) is

Expert Answer:

Answer rating: 100% (QA)

nswers nd wrking re s fllws 1 2021 djusted Grss Inme Is 101900 2 2021 Txble Inme is 74100 3 2021 ... View the full answer

Related Book For

Engineering Economy

ISBN: 978-0132554909

15th edition

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Posted Date:

Students also viewed these business communication questions

-

A lawsuit a few years ago made headlines worldwide when a McDonalds drive-through customer spilled a cup of scalding hot coffee on herself. Claiming the coffee was too hot to be safely consumed in a...

-

A firm purchased copper pipes a few years ago at $ 10 per pipe and stored them, using them only as the need arises. The firm could sell its remaining pipes in the market at the current price of $ 9....

-

The average age of online consumers a few years ago was 23.3 years. As older individuals gain confidence with the Internet, it is believed that the average age has increased. We would like to test...

-

Determine the resultant force and specify where it acts on thebeam measured from A . Assume F = 540 lb . Part A Determine the magnitude of theresultant force. Part B Determine the distance between A...

-

Consider the following time series: a. Using a trend projection, forecast the demand for Period 9. b. Verify your results with PH Stat . c. Calculate the MAD for this forecast. Period 2 3 4 5 6 7 8...

-

Consider the two (excess return) index model regression results for stocks A and B: RA = .01 + 1.2RM R- squared = .576 ( e) = 10.3% RB = - .02 + .8RM R- squared = .436 (e) = 9.1% a. Which stock has...

-

For each of the following situations, calculate the \(z\)-statistic \((z)\), make a decision about the null hypothesis (reject, do not reject), and indicate the level of significance \((p>.05, p

-

At Western University the historical mean of scholarship examination scores for fresh-man applications is 900. A historical population standard deviation = 180 is assumed known. Each year, the...

-

Suppose you want to sell naked options on a bitcoin miner like MARA or RIOT. Could you hedge by also buying some bitcoin at a broker, or COINBASE? You would have to be very very explicit, showing a...

-

The fish department of the local grocery store faces unique problems. Fish is extremely perishable and can only be sold on the day it arrives in the store. Fish is delivered at 3 am and can be sold...

-

A researcher is interested in determining the effect of Ritalin on the activity level of normal and hyperactive children. Consent is obtained from 16 children and their parents to participate in the...

-

How does technology contribute to BPM enablement?

-

The Enablement phase is only necessary in certain BPM circumstances. What are these circumstances and why is the Enablement phase necessary?

-

Describe how an IT manager views the process versus automation first question.

-

What are the deliverables of the Understand phase?

-

Do you need to develop a high-level implementation plan at this stage, and if so, why?

-

What are the essential factors which led to the deterioration of the account? 2. How would you have strengthened the credit? 3. If you were the Account Officer, what would you now do under the...

-

The diameter of a sphere is 18 in. Find the largest volume of regular pyramid of altitude 15 in. that can be cut from the sphere if the pyramid is (a) square, (b) pentagonal, (c) hexagonal, and (d)...

-

Consider the following data on two pieces of equipment: a. Suppose that the capital investment on Equipment 1 is known with certainty. By how much would the estimate of capital investment on...

-

A manufacturing concern's total cost function is C = X/5 and its revenue function is R = 39 log(8X + 1). Find the optimum output where the profit is maximized and the maximum profit.

-

A group of private investors borrowed $30 million to build 300 new luxury apartments near a large university. The money was borrowed at 6% annual interest, and the loan is to be repaid in equal...

-

Plaintiff applied for a job at Neiman Marcuss Oak Brook, Illinois, store as an entry-level dress collections sales associate. Ohle was interviewed and was informed that she should expect an offer for...

-

Plaintiff Deborah Ehling was hired by Monmouth-Ocean Hospital Service Corp. (MONOC) in 2004 as a registered nurse and paramedic. Plaintiffs claims in this case arise out of an incident involving her...

-

Reynaldo Delgado died following an explosion at a smelting plant in Deming, New Mexico, after a supervisor ordered him to perform a task that, according to Delgados widow, was virtually certain to...

Study smarter with the SolutionInn App