Question: - Meme 50. Layout Dr Formulas Data Review Vies 4 QUESTION 1 Beach Front Foods Inc. has decided to add a delivery service to its

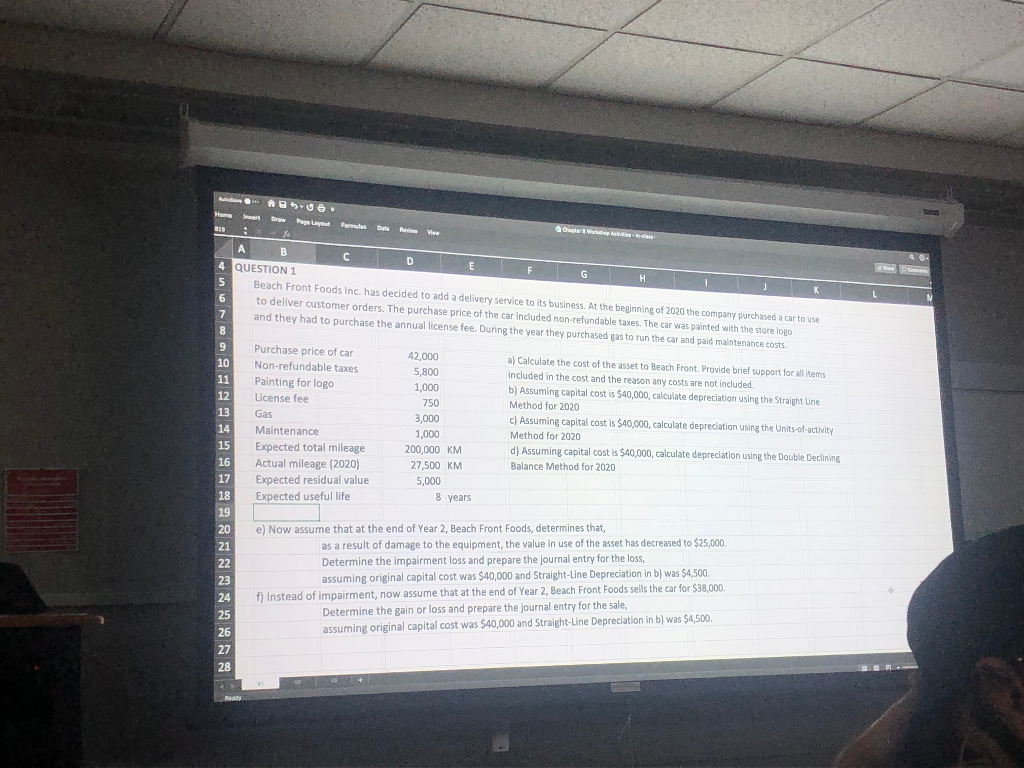

- Meme 50. Layout Dr Formulas Data Review Vies 4 QUESTION 1 Beach Front Foods Inc. has decided to add a delivery service to its business. At the beginning of 2020 the company purchased a car to use to deliver customer orders. The purchase price of the car included non-refundable taxes. The car was painted with the store logo and they had to purchase the annual license fee. During the year they purchased gas to run the car and paid maintenance costs. 00 Purchase price of car Non-refundable taxes Painting for logo License fee Gas Maintenance Expected total mileage Actual mileage (2020) Expected residual value Expected useful life 42,000 5,800 1,000 750 3,000 1,000 200,000 KM 27,500 KM 5,000 8 years a) Calculate the cost of the asset to Beach Front. Provide brief support for all items included in the cost and the reason any costs are not included b) Assuming capital cost is $40,000, calculate depreciation using the Straight line Method for 2020 c) Assuming capital cost is $40,000, calculate depreciation using the Units-of-activity Method for 2020 d) Assuming capital cost is $40,000, calculate depreciation using the Double Declining Balance Method for 2020 e) Now assume that at the end of Year 2, Beach Front Foods, determines that, as a result of damage to the equipment, the value in use of the asset has decreased to $25,000 Determine the impairment loss and prepare the journal entry for the loss, assuming original capital cost was $40,000 and Straight-Line Depreciation in b) was $4,500 f) Instead of impairment, now assume that at the end of Year 2, Beach Front Foods sells the car for $38,000 Determine the gain or loss and prepare the journal entry for the sale, assuming original capital cost was $40,000 and Straight-Line Depreciation in b) was $4,500. - Meme 50. Layout Dr Formulas Data Review Vies 4 QUESTION 1 Beach Front Foods Inc. has decided to add a delivery service to its business. At the beginning of 2020 the company purchased a car to use to deliver customer orders. The purchase price of the car included non-refundable taxes. The car was painted with the store logo and they had to purchase the annual license fee. During the year they purchased gas to run the car and paid maintenance costs. 00 Purchase price of car Non-refundable taxes Painting for logo License fee Gas Maintenance Expected total mileage Actual mileage (2020) Expected residual value Expected useful life 42,000 5,800 1,000 750 3,000 1,000 200,000 KM 27,500 KM 5,000 8 years a) Calculate the cost of the asset to Beach Front. Provide brief support for all items included in the cost and the reason any costs are not included b) Assuming capital cost is $40,000, calculate depreciation using the Straight line Method for 2020 c) Assuming capital cost is $40,000, calculate depreciation using the Units-of-activity Method for 2020 d) Assuming capital cost is $40,000, calculate depreciation using the Double Declining Balance Method for 2020 e) Now assume that at the end of Year 2, Beach Front Foods, determines that, as a result of damage to the equipment, the value in use of the asset has decreased to $25,000 Determine the impairment loss and prepare the journal entry for the loss, assuming original capital cost was $40,000 and Straight-Line Depreciation in b) was $4,500 f) Instead of impairment, now assume that at the end of Year 2, Beach Front Foods sells the car for $38,000 Determine the gain or loss and prepare the journal entry for the sale, assuming original capital cost was $40,000 and Straight-Line Depreciation in b) was $4,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts