Question: Memo 4 On January 1 , 2 0 2 5 , John Smith started to work as a financial analyst in the equity department of

Memo

On January John Smith started to work as a financial analyst in the equity department of the Traveler Mutual Funds. As an entry level financial analyst, his job is to help value the stocks assilened by the fund manages, Ben Ashford. Mr Ashford is considering whether Traveler should whether the fund should buy Ford's stocks more.

John recalled that he had learned the dividend growth model in his finance course to estimate the intrinilc value of a stock. To implement the dividend growth model, he first needed to know the current dividend payment of Ford. Second, he needed to estimate the growth rate of dividens: forever. Finally he needed to estimate the required rate of return of the stock based on the rids teut of the thod:

John next finlshed the following jobs:

Browsed Yahoo Finance and found the symbol for Ford's stock.

On Yahoo Finance, John checked Ford's dividend payment for the year Under "Historical Data" he looked at Dividend only pay ments.

On Yahoo Finance, John checked "Growth Est" under "Analysis": He thought that the growth rate for the next year for Ford could help him estimate the growth rate of dividends forever.

Based on the risk level of Ford's stock, he estimated the required rate of return of the stock was around

Base on the estimates he obtained from through John input the estimates to the dividend growth model to estimate the intrinaic value of the Ford's stock.

Since John knew that the estimated intrinsic value of a stock based on the dividend growth model is very sensitive to the estimated growth rate of dividends. Hence, he did the sensitivity analysis to see how the intrinsic value will be if the estimated growth rate changes.

After John finished all the jobs above, he wrote a memo to Mr Ashford to summarize his analysis and results.

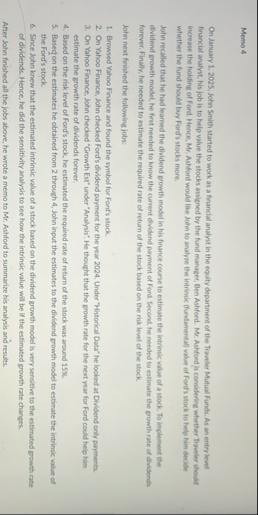

tableUse the Dividend Growth Model DGM to Value Ford's Stock in special Dividend paid in $Own,,Estimated dividend growth rate forever,Required rate of return,Fundamental value of the stock in OrSensitivity Analysis:,Estimated dividend growth rate,Stock Value,,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock