Question: Consider the following investment options. 1) A bond with an equal probability of the rate of return of 5% or 15%. 2)A bond with

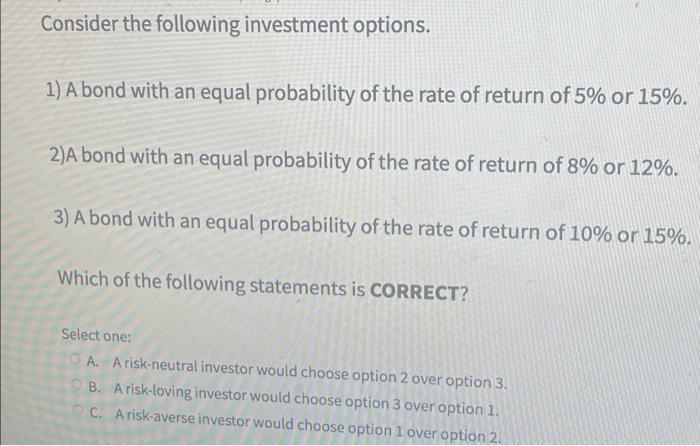

Consider the following investment options. 1) A bond with an equal probability of the rate of return of 5% or 15%. 2)A bond with an equal probability of the rate of return of 8% or 12%. 3) A bond with an equal probability of the rate of return of 10% or 15%. Which of the following statements is CORRECT? Select one: A. A risk-neutral investor would choose option 2 over option 3. B. A risk-loving investor would choose option 3 over option 1. C. A risk-averse investor would choose option 1 over option 2.

Step by Step Solution

3.59 Rating (156 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provi... View full answer

Get step-by-step solutions from verified subject matter experts