Question: ment CALCULATOR PRINTER VERSION HACK Problem 10-2Ab, (Video) Zelmer Company manufactures tablecloths. Sales have grown rapidly over the past 2 years. As a result, the

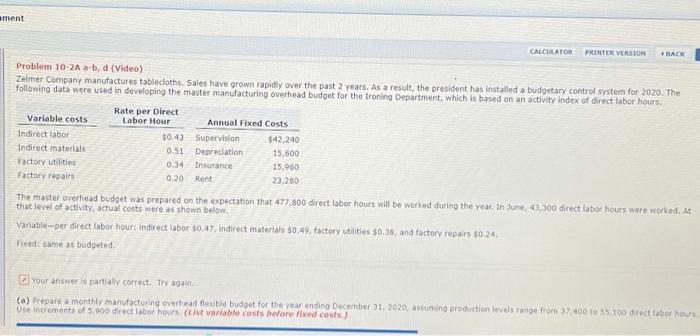

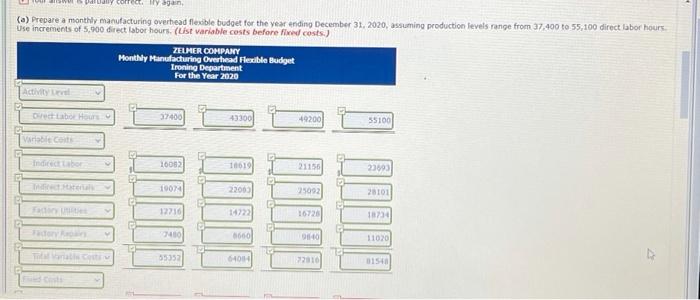

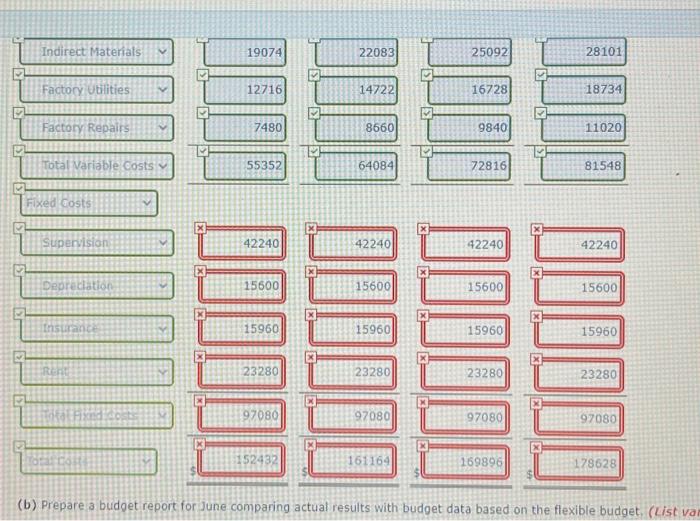

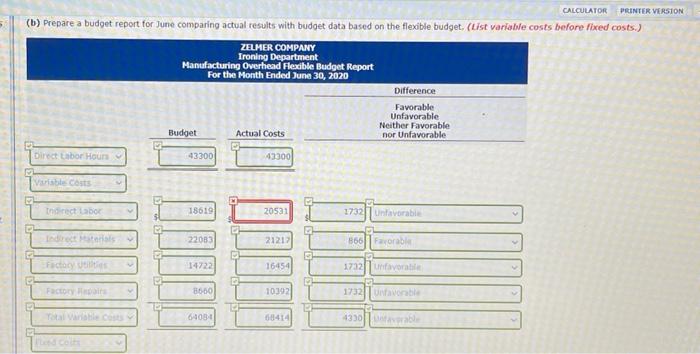

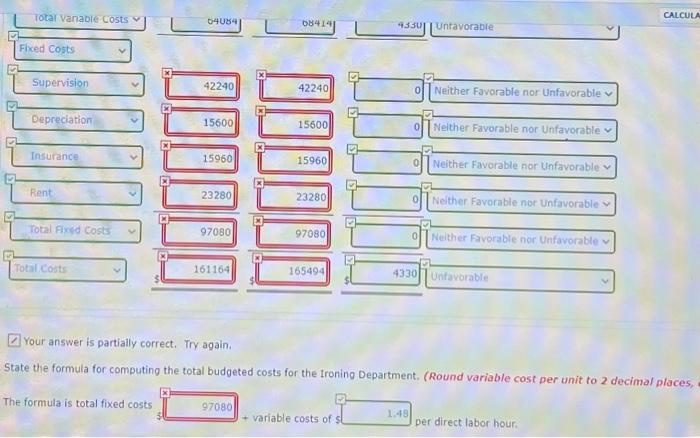

ment CALCULATOR PRINTER VERSION HACK Problem 10-2Ab, (Video) Zelmer Company manufactures tablecloths. Sales have grown rapidly over the past 2 years. As a result, the president has installed a budgetary control system for 2020. The following data were used in developing the master manufacturing overhead budget for the froning Department, which is based on an activity Index of direct labor hours. Variable costs Rate per Direct Labor Hour Annual Fixed Costs Indirect labor $42,240 Indirect materials 30.4) Supervision 0.51 Depreciation 15,600 Factory utilities 0:34 Insurance 25.960 Factory repairs 0:20 Rent 23.250 The master overhead budget was prepared on the expectation that 477,800 direct labor hours will be worked during the year. In June, 43,300 direct labor hours were worked. At that level of activity, actual costs were as shown below Variable-per direct labor hours Indirect labor $0.47, indirect materials 50:49. factory utilities $0.36, and factory repairs $0.24 Fixed: same as budete your answer is partially correct. Try again () Prepare a monthly manufacturing overhead flexible budget for the year ending December 31, 2020, assuming Droduction levels range from 37,400 to 55,100 direct labor hours Use increments of 5.900 direct labor hours at variable costs before Fixed costs Parody correct again, (a) Prepare a monthly manufacturing overhead flexible budget for the year ending December 31, 2020, assuming production levels range from 37.400 to 55,100 direct labor hours Use increments of 5.000 direct labor hours. (List variable costs before le costs.) ZELHER COMPANY Monthly Manufacturing Overhead Flexible Budget Ironing Department For the Year 2020 Activity v retabo Hour 37400 43300 49200 35100 Variable G Indirect labor 16082 10619 21150 23993 10074 22003 25092 28101 E 12710 16726 14 . 7460 5600 940 11030 6535 64014 2010 015 Indirect Materials 19074 22083 25092 28101 PL Factory Utilities 12716 14722 16728 18734 Factory Repairs 7480 8660 9840 11020 Total Variable costs 55352 64084 72816 81548 Fixed costs Supervision 42240 42240 42240 42240 Deprecation 15600 15600 15600 15600 X insand 15960 15960 15960 15960 23280 23280 23280 23280 x Hand 97080 97080 97080 97080 152432 161164 169896 178628 (b) Prepare a budget report for June comparing actual results with budget data based on the flexible budget (uist van CALCULATOR PRINTER VERSION (b) Prepare a budget report for June comparing actual results with budget data based on the flexible budget. (List variable costs before fixed costs.) 5 ZELMER COMPANY Ironing Department Manufacturing Overhead Fleable Budget Report For the Month Ended June 30, 2020 Difference Favorable Unfavorable Neither Favorable nor Unfavorable Budget Actual Costs Direct Labor Hours 43300 43300 Variable costs Indirect labor 18619 20531 1732 Unfavorable 22083 21212 866 Favorable 14722 16454 1732] unfavorable Factory 3600 10392 1732avable E 640844 4330 Total Vanable costs CALCULA 04084 0841 43301 Unfavorable Fixed costs Supervision 42240 42240 o Neither Favorable nor Unfavorable v Depreciation 15600 15600 0 Neither Favorable nor Unfavorable Insurance 15960 15960 0 Neither Favorable nor Unfavorable Rent 23280 232801 0 Neither Favorable nor Unfavorable x Total Fed Costs 97080 97080 0 Neither favorable nor Unfavorable Total costs 161164 165494 43301 Unfavorable El your answer is partially correct. Try again. State the formula for computing the total budgeted costs for the froning Department. (Round variable cost per unit to 2 decimal places, The formula is total fixed costs 97080 + variable costs of sl 1.48 per direct labor hour

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts