Question: mentindo - Selocatori progress-false Module 4 Assignment el Show Me How Calculator Determine the amount of sales (unts) that would be made Break Even Sales

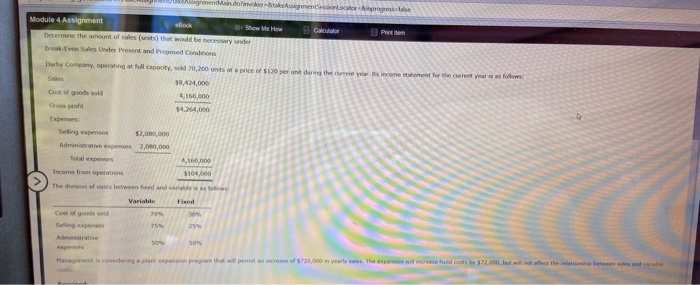

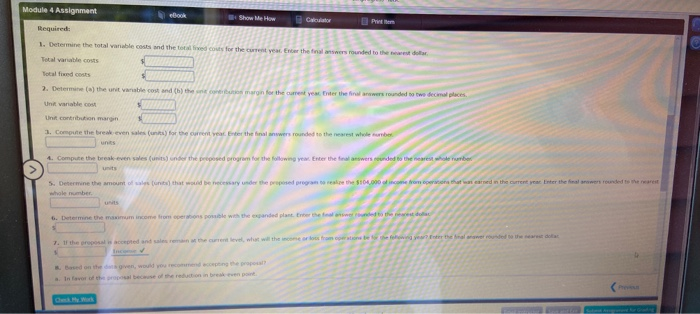

mentindo - Selocatori progress-false Module 4 Assignment el Show Me How Calculator Determine the amount of sales (unts) that would be made Break Even Sales Under Present and Proposed Conditions Duty Company operating at full capacity, sold 70,200 units at a pnce of $120 per unit during the current yw is income statement for the current year is as follows: Sales 8,424,000 Cost of goods sold 4,160,000 Gross profit 54.264,000 Selling expenses $2,080,000 Administrative expers 2,080,000 Talepenses 4,160,000 Income from operations 5104,000 The division of costs between fod and was follows: Variable Cost of goods sold 709 30% Segexpenses Administrative Son 50% Management is condering program that will perman increase 20.000 in yearly sales. The pansion is fed costs by $2.000, but will not afect there between and Module 4 Assignment book Show Me How Required: 1. Determine the total variable costs and the total red comes for the current you rear the transwers rounded to the west do Total variable costs Total wed costs 2. Determine (a) the unit variable cost and then comertion margin for the current your biter the final swwers rounded to two decimal places Unit variable cost Unt contribution margin 1. Compute the break even sales() for the current year Enter the finalwers rounded to the nearest web unts 1. Compute the break-even sales (unit) under the proposed program for the following year. Enter the fanswers founded to the nearest whole number 5. Determine the amount of sales that would be necessary under the proposed program terakce the $100.000 income from operator that was earned in the current year. Enter the final rounded the rest whole number 6. Determine the maximum income from ons posible with the expanded plant Enter the father mentindo - Selocatori progress-false Module 4 Assignment el Show Me How Calculator Determine the amount of sales (unts) that would be made Break Even Sales Under Present and Proposed Conditions Duty Company operating at full capacity, sold 70,200 units at a pnce of $120 per unit during the current yw is income statement for the current year is as follows: Sales 8,424,000 Cost of goods sold 4,160,000 Gross profit 54.264,000 Selling expenses $2,080,000 Administrative expers 2,080,000 Talepenses 4,160,000 Income from operations 5104,000 The division of costs between fod and was follows: Variable Cost of goods sold 709 30% Segexpenses Administrative Son 50% Management is condering program that will perman increase 20.000 in yearly sales. The pansion is fed costs by $2.000, but will not afect there between and Module 4 Assignment book Show Me How Required: 1. Determine the total variable costs and the total red comes for the current you rear the transwers rounded to the west do Total variable costs Total wed costs 2. Determine (a) the unit variable cost and then comertion margin for the current your biter the final swwers rounded to two decimal places Unit variable cost Unt contribution margin 1. Compute the break even sales() for the current year Enter the finalwers rounded to the nearest web unts 1. Compute the break-even sales (unit) under the proposed program for the following year. Enter the fanswers founded to the nearest whole number 5. Determine the amount of sales that would be necessary under the proposed program terakce the $100.000 income from operator that was earned in the current year. Enter the final rounded the rest whole number 6. Determine the maximum income from ons posible with the expanded plant Enter the father

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts