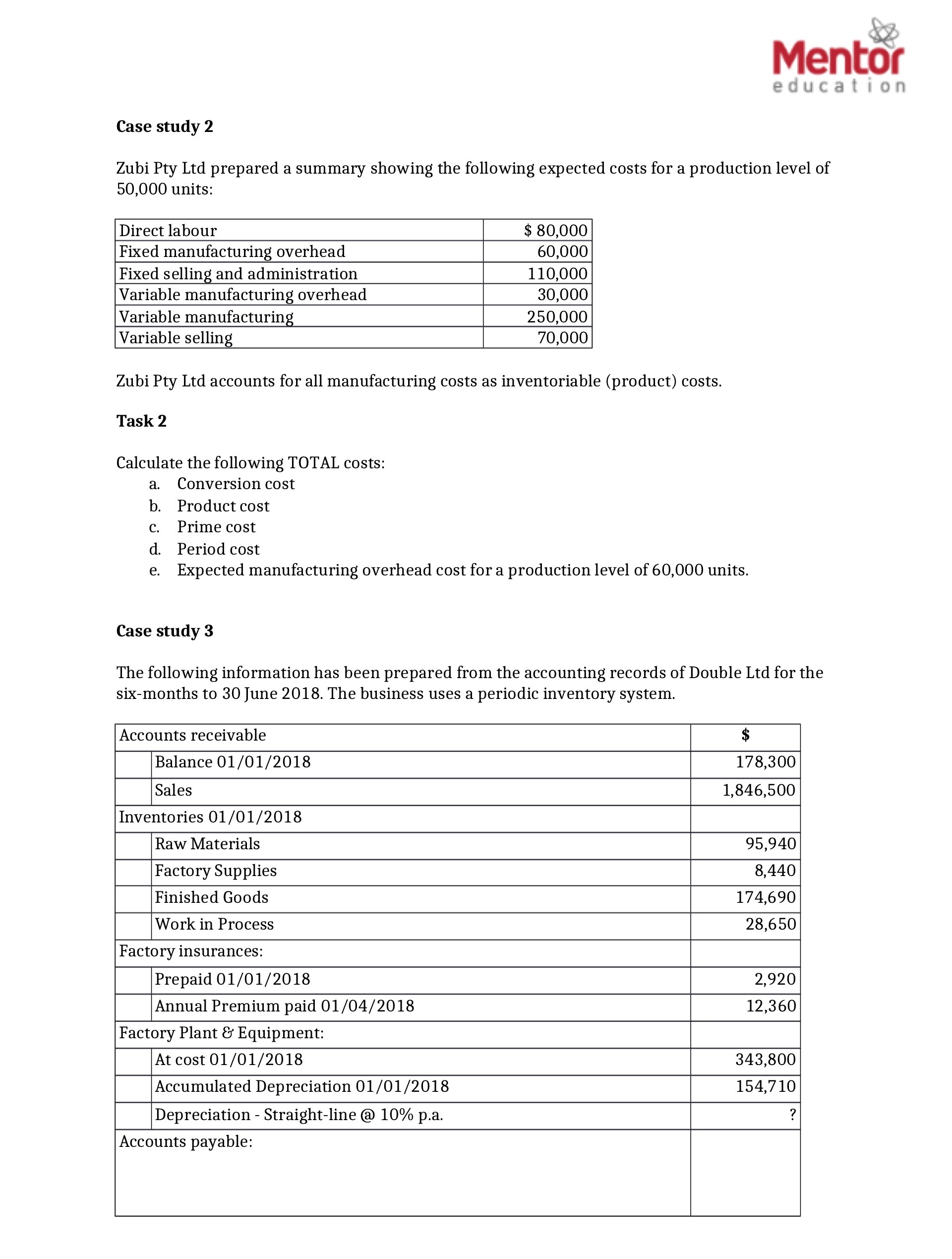

Question: Mentor education Case study 2 Zubi Pty Ltd prepared a summary showing the following expected costs for a production level of 50,000 units: Direct labour

Mentor education Case study 2 Zubi Pty Ltd prepared a summary showing the following expected costs for a production level of 50,000 units: Direct labour $ 80,000 Fixed manufacturing overhead 60,000 Fixed selling and administration 110,000 Variable manufacturing overhead 30,000 Variable manufacturing 250,000 Variable selling 70,000 Zubi Pty Ltd accounts for all manufacturing costs as inventoriable (product) costs. Task 2 Calculate the following TOTAL costs: a. Conversion cost b. Product cost C. Prime cost d. Period cost e. Expected manufacturing overhead cost for a production level of 60,000 units. Case study 3 The following information has been prepared from the accounting records of Double Ltd for the six-months to 30 June 2018. The business uses a periodic inventory system. Accounts receivable $ Balance 01/01/2018 178,300 Sales 1,846,500 Inventories 01/01/2018 Raw Materials 95,940 Factory Supplies 8,440 Finished Goods 174,690 Work in Process 28,650 Factory insurances: Prepaid 01/01/2018 2,920 Annual Premium paid 01/04/2018 12,360 Factory Plant & Equipment: At cost 01/01/2018 343,800 Accumulated Depreciation 01/01/2018 154,710 Depreciation - Straight-line @ 10% p.a. Accounts payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts