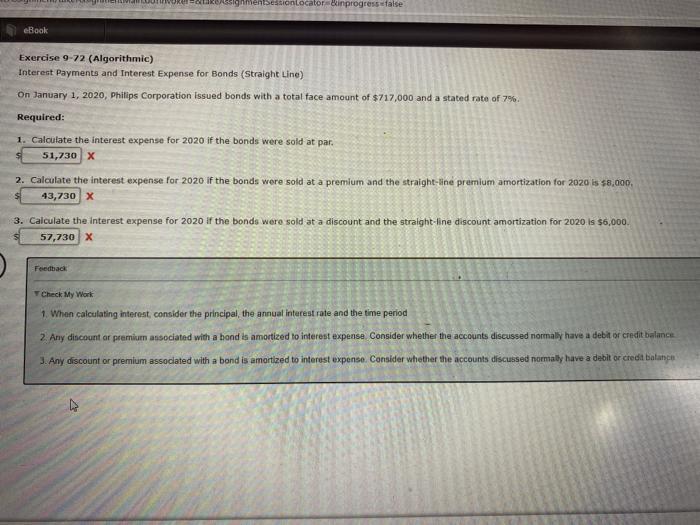

Question: MentSessionLocator Binprogress false eBook Exercise 9-72 (Algorithmic) Interest Payments and Interest Expense for Bonds (Straight Line) on January 1, 2020, Philips Corporation issued bonds with

MentSessionLocator Binprogress false eBook Exercise 9-72 (Algorithmic) Interest Payments and Interest Expense for Bonds (Straight Line) on January 1, 2020, Philips Corporation issued bonds with a total face amount of $717,000 and a stated rate of 7% Required: 1. Calculate the interest expense for 2020 if the bonds were sold at par 51,730 x 2. Calculate the interest expense for 2020 if the bonds were sold at a premium and the straight-line premium amortization for 2020 is $8,000, 43,730 x 3. Calculate the Interest expense for 2020 If the bonds were sold at a discount and the straight-line discount amortization for 2020 is $6,000. 57,730 X Feedback Check My Work 1. When calculating interest, consider the principal, the annual interest rate and the time period 2 Any discount or premium associated with a hand is amortized to interest expense. Consider whether the accounts discussed normally have a debat or credit balance 3.Any discount or premium associated with a bond is amortized to interest expense. Consider whether the accounts discussed normally have a debitor credit balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts