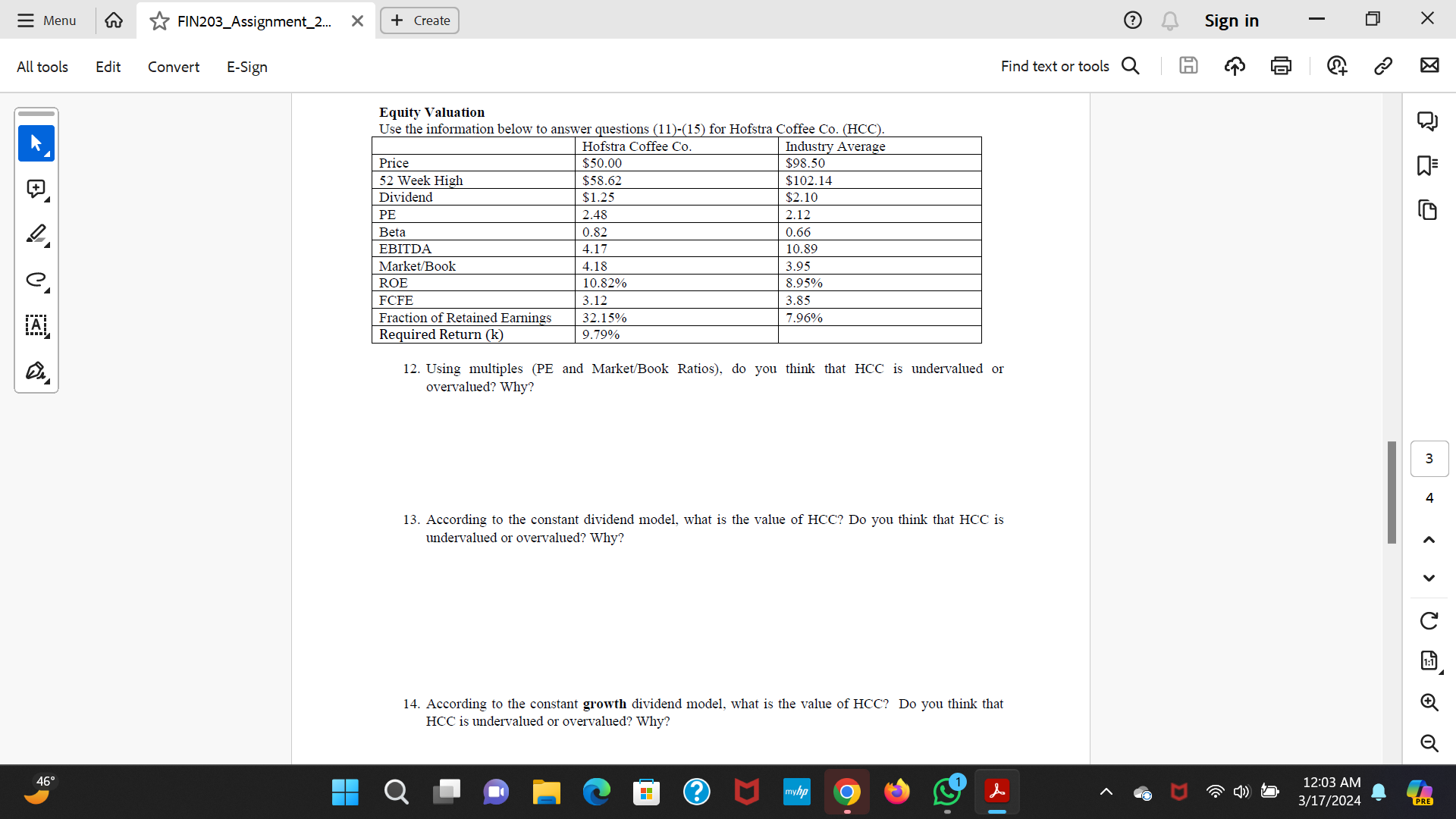

Question: = Menu FIN203_Assignment_2... + Create All tools Edit Convert E-Sign e 46 Equity Valuation Use the information below to answer questions (11)-(15) for Hofstra

= Menu FIN203_Assignment_2... + Create All tools Edit Convert E-Sign e 46 Equity Valuation Use the information below to answer questions (11)-(15) for Hofstra Coffee Co. (HCC). Industry Average Hofstra Coffee Co. Price $50.00 52 Week High Dividend $58.62 $1.25 PE Beta EBITDA Market/Book ROE 2.48 0.82 4.17 4.18 10.82% FCFE 3.12 Fraction of Retained Earnings 32.15% 9.79% $98.50 $102.14 $2.10 2.12 0.66 10.89 3.95 8.95% 3.85 7.96% (?) Find text or tools Q Required Return (k) 12. Using multiples (PE and Market/Book Ratios), do you think that HCC is undervalued or overvalued? Why? 13. According to the constant dividend model, what is the value of HCC? Do you think that HCC is undervalued or overvalued? Why? 14. According to the constant growth dividend model, what is the value of HCC? Do you think that HCC is undervalued or overvalued? Why? myhp +1 > Sign in 3 4 12:03 AM 3/17/2024 PRE = Menu FIN203_Assignment_2... + Create All tools Edit Convert E-Sign e 46 (?) Find text or tools Q 15. Now, instead assume that HGC will retain 60% of its earnings and earn an ROE of 15%. According to the dividend growth model, what is the value of HCC? Do you think that HCC is undervalued or overvalued? Why? 16. According to the Free Cash Flow Growth Model, what is the value of HCC (use the growth rate from (14)? Do you think that HCC is undervalued or overvalued)? Why? + myhp +1 Sign in > 4 4 12:03 AM 3/17/2024 PRE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts