Question: Mercer Corporation is considering replacing a technologically obsolete machine with a new state-of-the-art numerically controlled machine. The new machine would cost $130.000 and would have

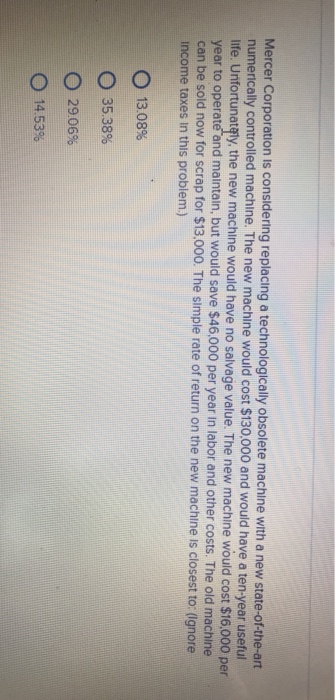

Mercer Corporation is considering replacing a technologically obsolete machine with a new state-of-the-art numerically controlled machine. The new machine would cost $130.000 and would have a ten-year useful life. Unfortunataly, the new machine would have no salvage value. The new machine would cost $16,000 per year to operate and maintalin, but would save $46.000 per year in labor and other costs. The old machine can be sold now for scrap for $13,000. The simple rate of return on the new machine Is closest to income taxes in this problem.) : (Ignore O 13.08% 35.38% 29.06% 14.53%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts