Question: Merge & Center $ % ) * 48 Conditional Format Formatting as Table Cell Styles Double Declining Balance Method Koffman's Warehouse purchased a forklift on

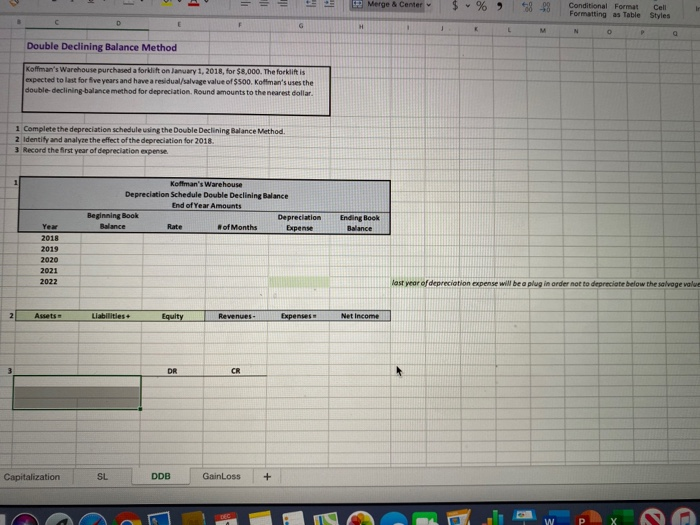

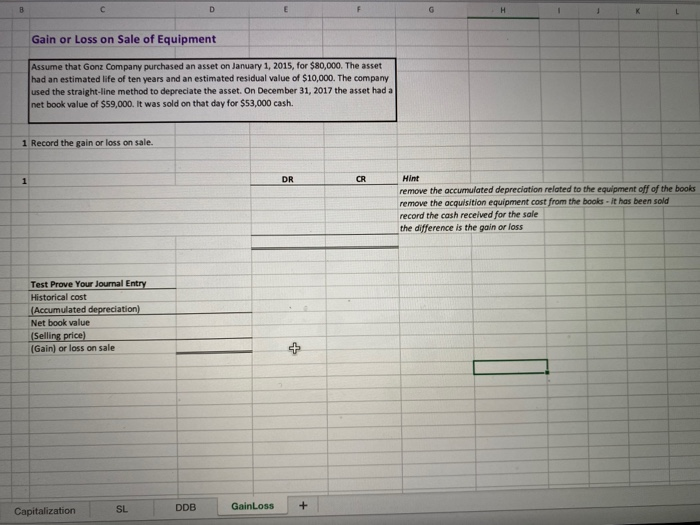

Merge & Center $ % ) * 48 Conditional Format Formatting as Table Cell Styles Double Declining Balance Method Koffman's Warehouse purchased a forklift on January 1, 2018, for $8,000. The forklift is expected to last for five years and have a residual/salvage value of $500. Kolman's uses the double declining balance method for depreciation. Round amounts to the nearest dollar. 1 Complete the depreciation schedule using the Double Declining Balance Method 2 Identity and analyze the effect of the depreciation for 2018. 3 Record the first year of depreciation expense. Koffman's Warehouse Depreciation Schedule Double Declining Balance End of Year Amounts Beginning Book Depreciation Balance Rate of Months Expense Ending Book Balance 2018 2019 2021 2022 be a plugin order not to depreciate below the vage will Assets Liabilities: Equity Capitalization SL D DB GainLoss + ALL WXN Gain or Loss on Sale of Equipment Assume that Gonz Company purchased an asset on January 1, 2015, for $80,000. The asset had an estimated life of ten years and an estimated residual value of $10,000. The company used the straight-line method to depreciate the asset. On December 31, 2017 the asset had a net book value of $59,000. It was sold on that day for $53,000 cash. 1 Record the gain or loss on sale. Hint remove the accumulated depreciation related to the equipment off of the books remove the acquisition equipment cost from the books - It has been sold record the cash received for the sale the difference is the gain or loss Test Prove Your Journal Entry Historical cost (Accumulated depreciation) Net book value (Selling price) (Gain) or loss on sale Capitalization SL DDB GainLoss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts