Question: merger analysis & adjusted present value approach // please help!! Merger valuation and discounted cash flows When a merger takes place between two companies to

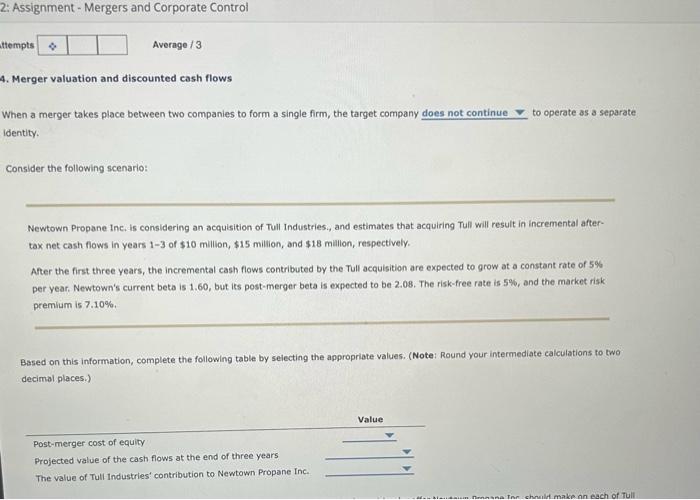

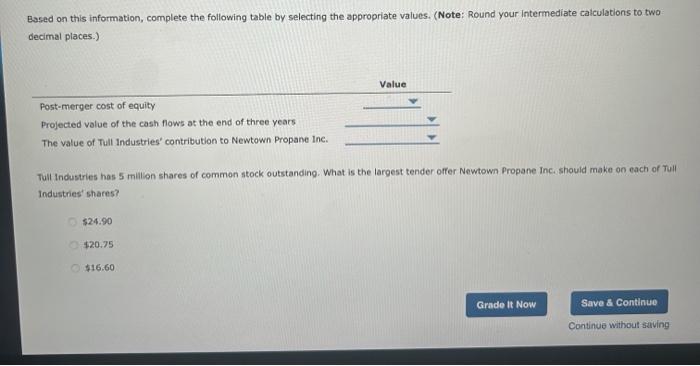

Merger valuation and discounted cash flows When a merger takes place between two companies to form a single firm, the target company to operate as a separate identity. Consider the following scenario: Newtown Propane inc. is considering an acquisition of Tull Industries., and estimates that acquiring Tull will result in incremental aftertax net cash flows in years 1-3 of $10 million, $15 million, and $18 million, respectively. Atter the first three years, the incremental cash flows contributed by the Tull acquisition are expected to grow at a constant rate of 5% per year. Newtown's current beta is 1.60, but its post-merger beta is expected to be 2.08. The risk-free rate is 5%, and the market risk premlum is 7.10%. Based on this information, complete the following table by selecting the appropriate values. (Note: Round your intermediate calculations to two decimal places.) Based on this information, complete the following table by selecting the appropriate values. (Note: Round your intermediate calculations to two decimal places.) Tull Industries has 5 milion shares of common stock outstanding. What is the largest tender offer Newtown Propane Inc. should make on each of Tull Industries' shares? 524.90 $20.75 $16.60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts