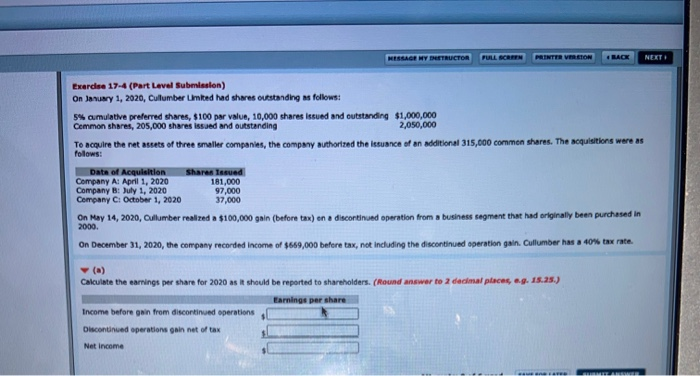

Question: MESSAGE MY DESTRUCTOR PULL SCREEN PRINTER VARETON LACK NETTI Exercise 17-4 (Part Level Submission) On Janusy 1, 2020, Cullumber Umited had shares outstanding as follows:

MESSAGE MY DESTRUCTOR PULL SCREEN PRINTER VARETON LACK NETTI Exercise 17-4 (Part Level Submission) On Janusy 1, 2020, Cullumber Umited had shares outstanding as follows: 5% cumulative preferred shares, $100 par value, 10,000 shares issued and outstanding $1,000,000 Common shares, 205,000 shares issued and outstanding 2,050,000 To acquire the netweets of three smaller companies, the company authorized the issuance of an additional 315,000 commen shares. The acquisitions were as Date of Acquisition Share Terued Company Al April 1, 2020 181,000 Company B: July 1, 2020 97,000 Company C1 October 1, 2020 37,000 On May 14, 2020, Oulumber realized a $100,000 gain (before tax) en a discortinand operation from a business segment that had originally been purchased in 2000 On December 31, 2020, the company recorded Income of $689,000 before tax, not including the discontinued operation gain. Cullumber has a wom tax rate. Calculate the earnings per share for 2020 as it should be reported to shareholders. (Round answer to 2 decimal places, ag. 15.25.) Earnings per share Income before gain from discontinued operations Discontinued operations gain net of tax Net Income LELA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts