Question: MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK NEXT Mini-Case 8.56 (Part Level Submission) Vines Company is a manufacturer of women's and men's swimsuits. The

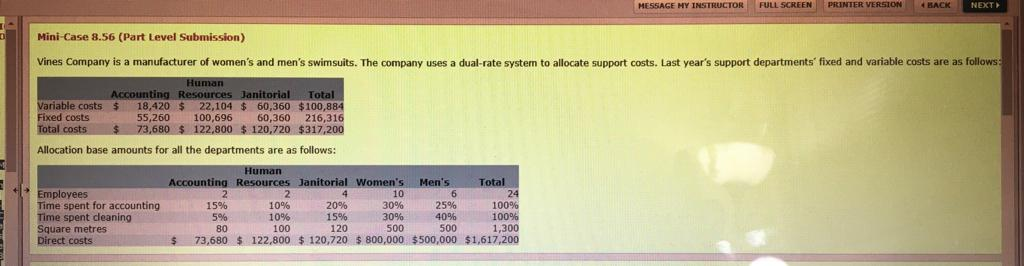

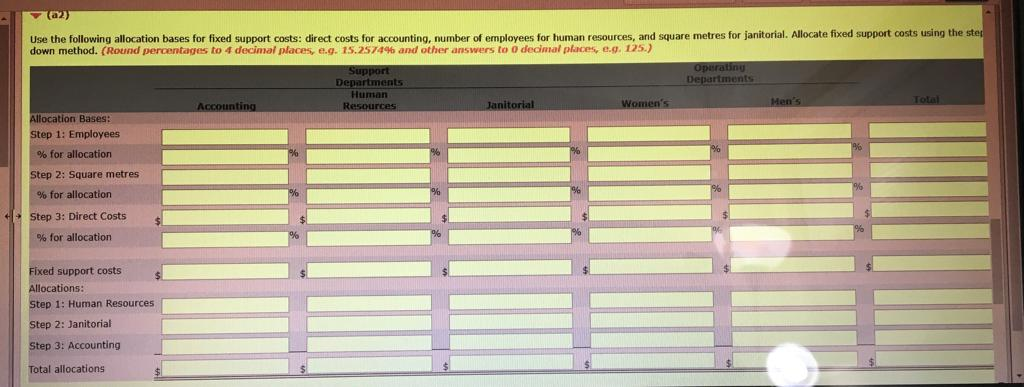

MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK NEXT Mini-Case 8.56 (Part Level Submission) Vines Company is a manufacturer of women's and men's swimsuits. The company uses a dual-rate system to allocate support costs. Last year's support departments fixed and variable costs are as follows: Human Accounting Resources Janitorial Total Variable costs $ 18,420 $ 22,104 $ 60,360 $100,884 Fixed costs 55,260 100,696 60,360 216,316 Total costs $ 73,680 $ 122,800 $ 120,720 $317,200 Allocation base amounts for all the departments are as follows: 24 Employees Time spent for accounting Time spent deaning Square metres Direct costs Human Accounting Resources Janitorial Women's Men's Total 10 6 15% 10% 20% 30% 25% 100% 5% 10% 15% 30% 40% 100% 100 120 500 1,300 $ 73,680 $ 122,800 $ 120,720 $ 800,000 $500,000 $1,617,200 500 Use the following allocation bases for fixed support costs: direct costs for accounting, number of employees for human resources, and square metres for janitorial. Allocate fixed support costs using the sted down method. (Round percentages to 4 decimal places 1.9.15.2574% and other answers to o decimal place .g. 125.) Support Operating Departments Departments Human Accounting Resources Janitorial Women's Allocation Bases: Step 1: Employees % for allocation Step 2: Square metres % for allocation Step 3: Direct Costs % for allocation Fixed support costs Allocations: Step 1: Human Resources Step 2: Janitorial Step 3: Accounting Total allocations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts