Question: Messages > Question 8 - WK 2. Apply Work X + ucation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%2 Norking Capital Management (due D... Saved Liquidity Premium Hypothesis Based on economists' forecasts

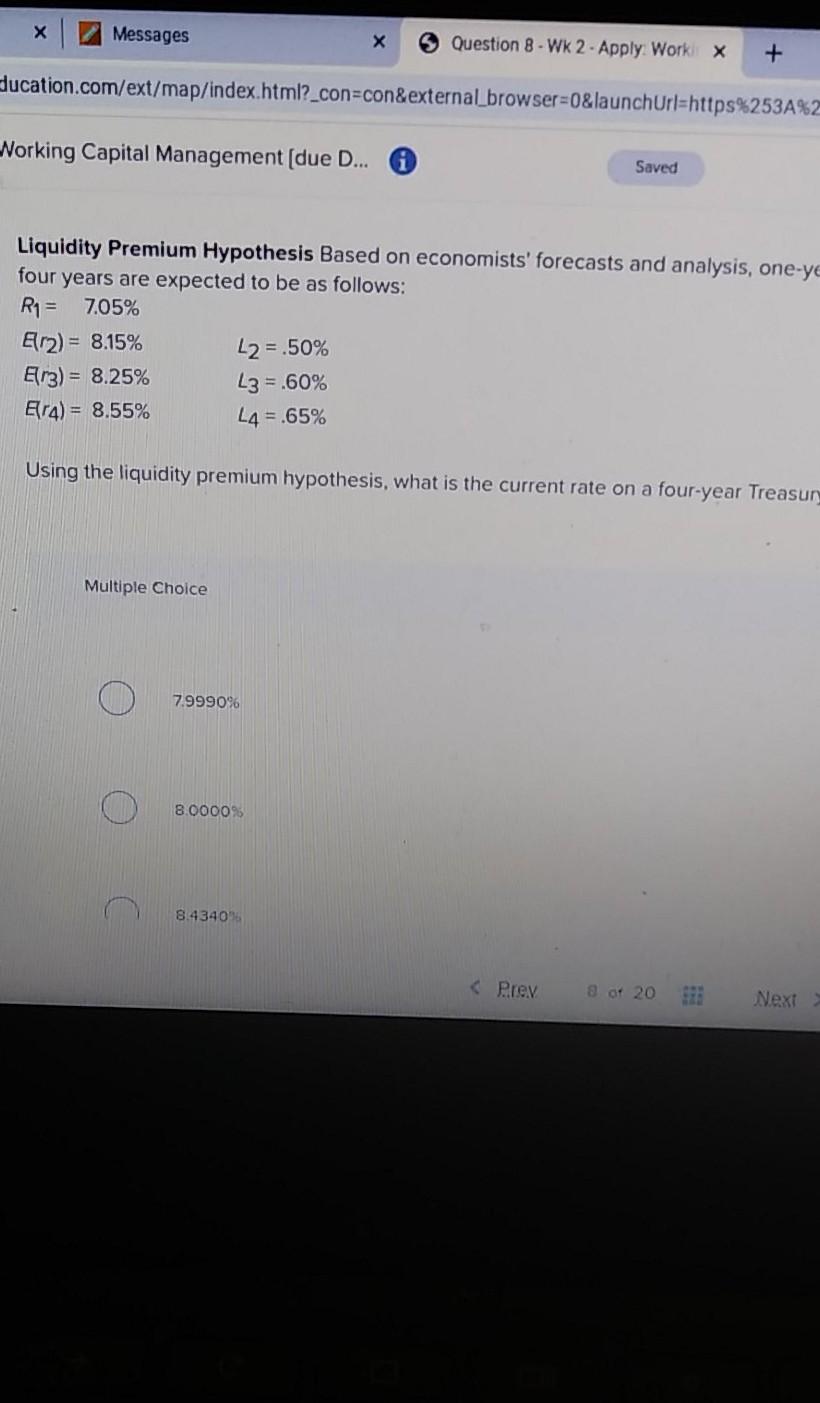

Messages > Question 8 - WK 2. Apply Work X + ucation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%2 Norking Capital Management (due D... Saved Liquidity Premium Hypothesis Based on economists' forecasts and analysis, one-ye four years are expected to be as follows: R1 = 7.05% Elr2) = 8.15% L2 =.50% Elr3) = 8.25% L3 = .60% Er4) = 8.55% L4 = 65% Using the liquidity premium hypothesis, what is the current rate on a four-year Treasun Multiple Choice 7.9990% 8.0000% 8.434036 Question 8 - WK 2. Apply Work X + ucation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%2 Norking Capital Management (due D... Saved Liquidity Premium Hypothesis Based on economists' forecasts and analysis, one-ye four years are expected to be as follows: R1 = 7.05% Elr2) = 8.15% L2 =.50% Elr3) = 8.25% L3 = .60% Er4) = 8.55% L4 = 65% Using the liquidity premium hypothesis, what is the current rate on a four-year Treasun Multiple Choice 7.9990% 8.0000% 8.434036

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts