Question: met Show all your work here partial Awwww com Pewny Good Luck im is evaluating two projects that are mutually exclusive with initial investmen was

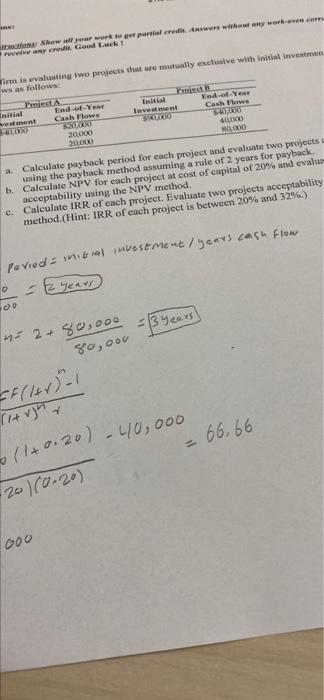

met Show all your work here partial Awwww com Pewny Good Luck im is evaluating two projects that are mutually exclusive with initial investmen was follows: Priest End-of-Year End-of-Year Cash Flows Investment Cash Flow SOMO SOS SO 20000 40.000 20000 000 Calculate payback period for each project and evaluate two projects using the payback method assuming a rule of 2 years for payback b. Calculate NPV for each project at cost of capital of 20% and evalue acceptability using the NPV method c. Calculate IRR of each project. Evaluate two projects acceptability method.(Hint: IRR of each project is between 20% and 32%) period initial investment/ years cash flow - 2 years 0 13 years - 2 +80,000 80,000 (144)-1 retur (1+0.20) -40,000 20160.20) = 66, 66 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts