Question: Meta Platforms Inc (FB) is evaluating a virtual reality project with the following cash flows. Your task is to calculate the NPV, IRR, and

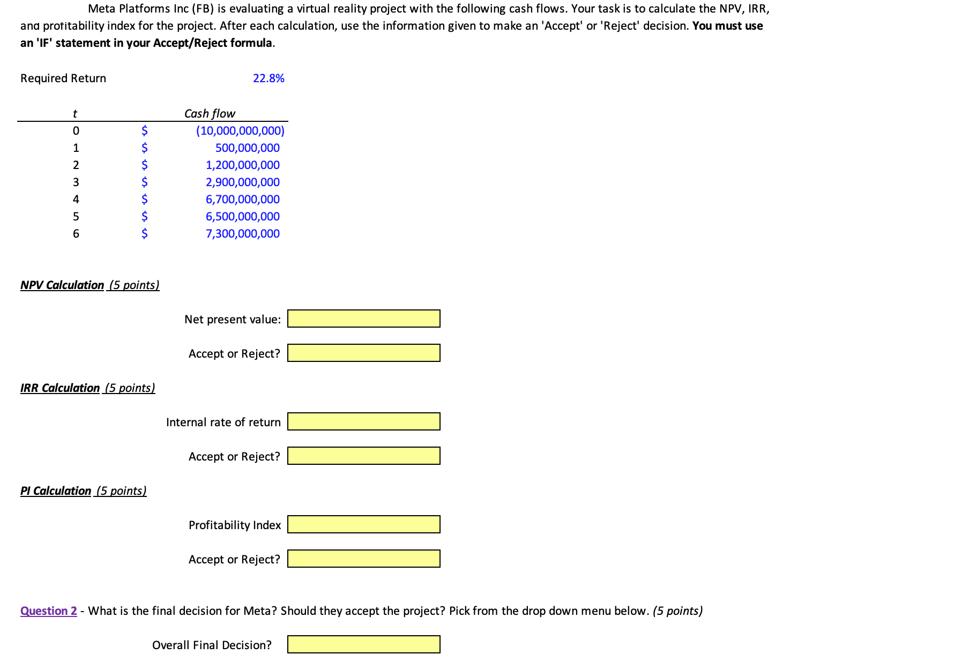

Meta Platforms Inc (FB) is evaluating a virtual reality project with the following cash flows. Your task is to calculate the NPV, IRR, and profitability index for the project. After each calculation, use the information given to make an 'Accept' or 'Reject' decision. You must use an 'IF' statement in your Accept/Reject formula. Required Return. t 0 1 2 3 4 5 6 $ $ $ $ $ $ $ NPV Calculation (5 points) IRR Calculation (5 points) PI Calculation (5 points) Cash flow 22.8% (10,000,000,000) 500,000,000 1,200,000,000 2,900,000,000 6,700,000,000 6,500,000,000 7,300,000,000 Net present value: Accept or Reject? Internal rate of return Accept or Reject? Profitability Index Accept or Reject? Question 2 - What is the final decision for Meta? Should they accept the project? Pick from the drop down menu below. (5 points) Overall Final Decision?

Step by Step Solution

There are 3 Steps involved in it

The question youre asking involves calculating the Net Present Value NPV Internal Rate of Return IRR and Profitability Index PI based on the cash flows presented and then making a decision whether to accept or reject the project based on these calculations Lets start with the NPV calculation The NPV is calculated by discounting each of the future cash flows back to their present value and subtracting the initial investment The formula to calculate the NPV is NPV sum CFt1 rt ight Initial Investment where CFt is the cash flow ... View full answer

Get step-by-step solutions from verified subject matter experts