Question: Metaline Corp. uses the weighted average method for inventory costs and had the following information available for the year. Calculate the equivalent units of production

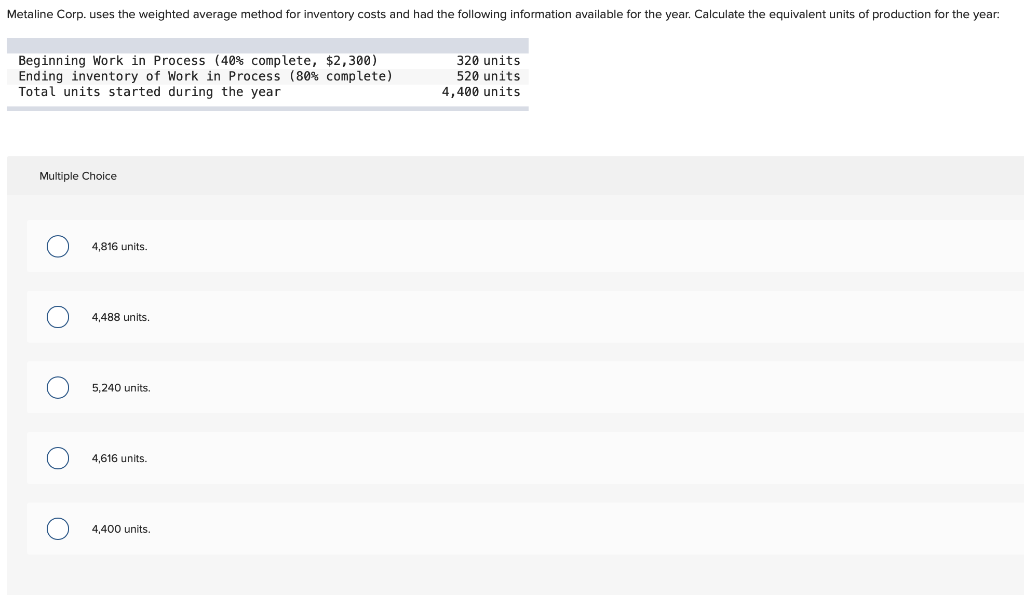

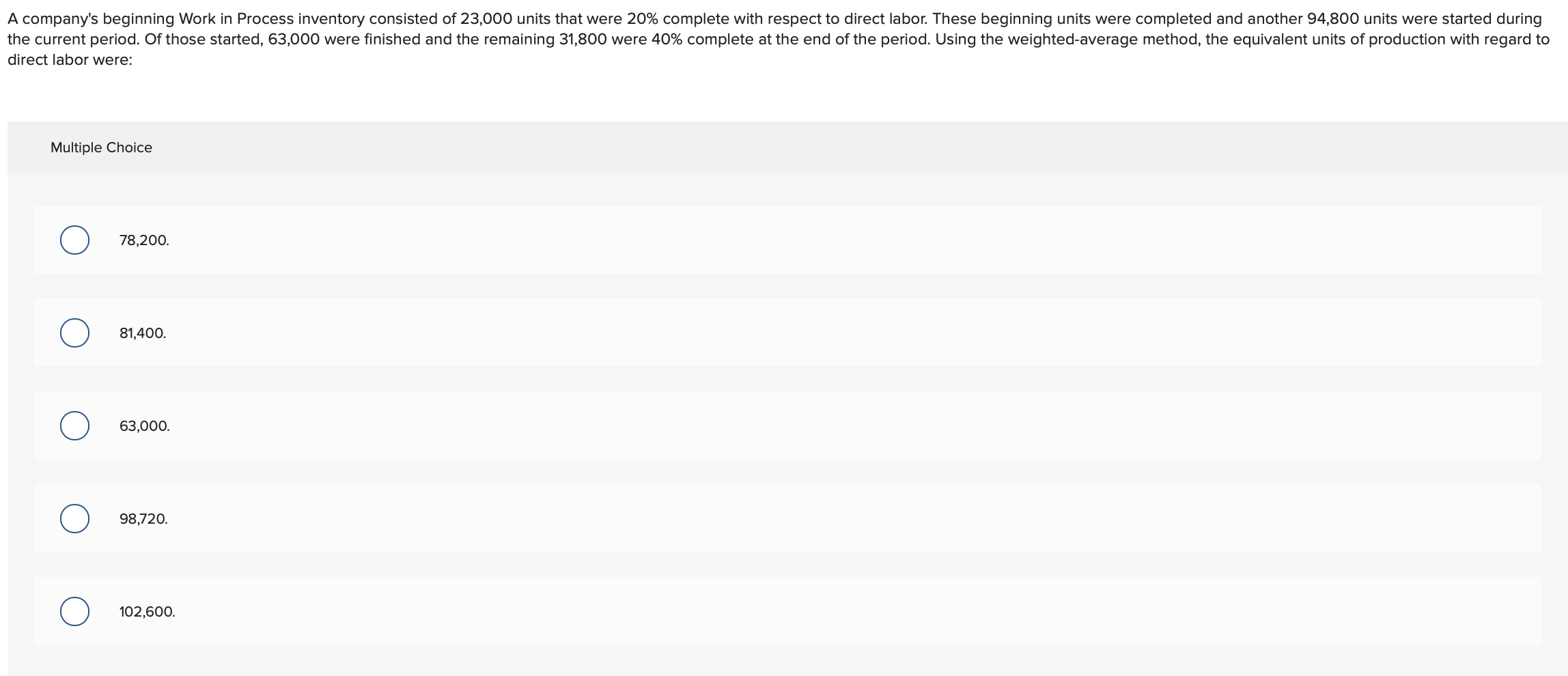

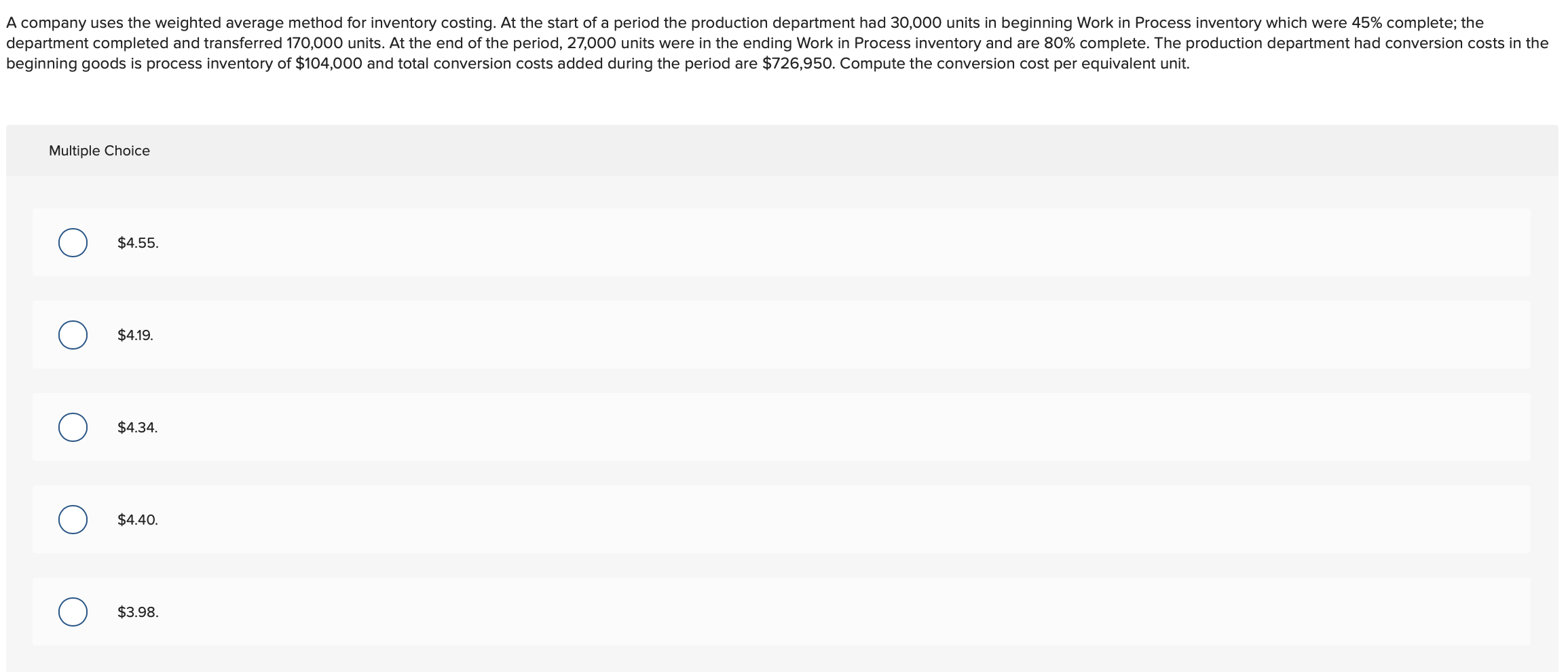

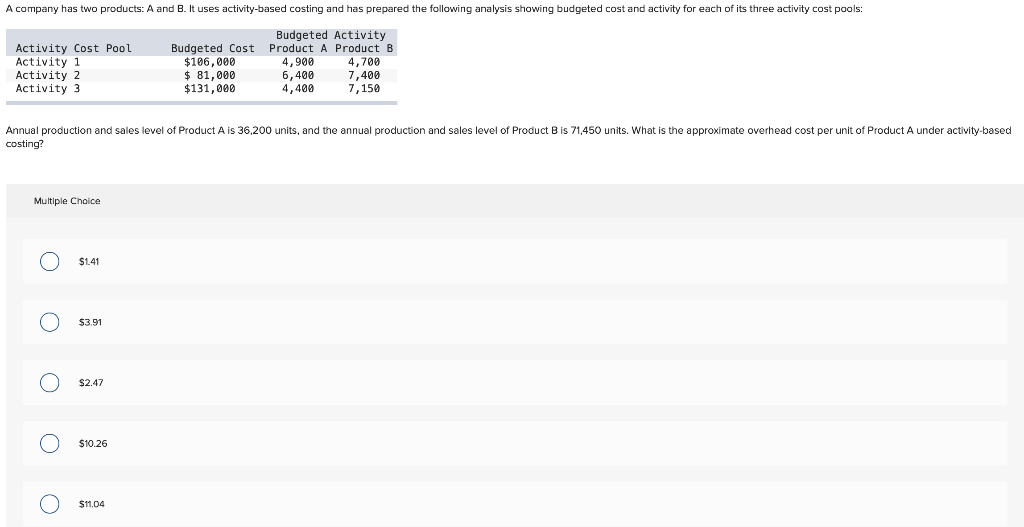

Metaline Corp. uses the weighted average method for inventory costs and had the following information available for the year. Calculate the equivalent units of production for the year. Beginning Work in Process (40% complete, $2,300) Ending inventory of Work in Process (80% complete) Total units started during the year 320 units 520 units 4,400 units Multiple Choice O 4,816 units. O 4,488 units 5,240 units. O O 4,616 units. 4.400 units. A company's beginning Work in Process inventory consisted of 23,000 units that were 20% complete with respect to direct labor. These beginning units were completed and another 94,800 units were started during the current period. Of those started, 63,000 were finished and the remaining 31,800 were 40% complete at the end of the period. Using the weighted-average method, the equivalent units of production with regard to direct labor were: Multiple Choice 78,200. 81,400. 63,000. 98,720. O 102,600. A company uses the weighted average method for inventory costing. At the start of a period the production department had 30,000 units in beginning Work in Process inventory which were 45% complete; the department completed and transferred 170,000 units. At the end of the period, 27,000 units were in the ending Work in Process inventory and are 80% complete. The production department had conversion costs in the beginning goods is process inventory of $104,000 and total conversion costs added during the period are $726,950. Compute the conversion cost per equivalent unit. Multiple Choice $4.55. $4.19. $4.34. $4.40. $3.98. A company has two products: A and B. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools: Activity Cost Pool Activity 1 Activity 2 Activity 3 Budgeted Cost $106,000 $ 81,000 $131,000 Budgeted Activity Product A Product B 4,900 4,700 6,400 7,400 4,400 7,150 Annual production and sales level of Product A is 36,200 units, and the annual production and sales level of Product B is 71,450 units. What is the approximate overhead cost per unit of Product A under activity-based costing? Multiple Choice O $1.41 $3.91 O $2.47 $10.26 d o $11.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts