Question: method using direct labor dollar as the allocation base and one cost pool Determine the overhead rate per direct labor dollar and the per unit

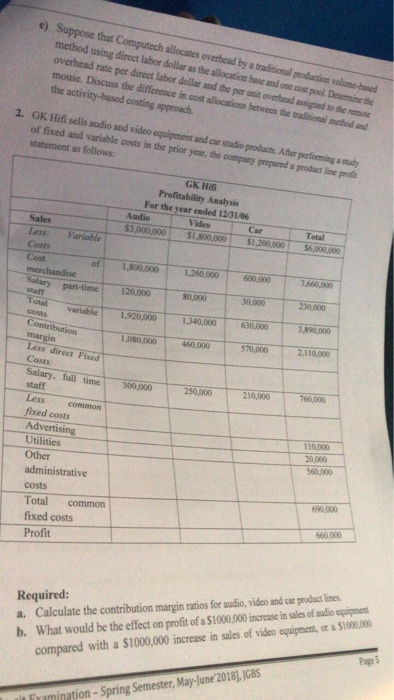

method using direct labor dollar as the allocation base and one cost pool Determine the overhead rate per direct labor dollar and the per unit overhead assigned to the remote mouse. Discuss the difference in cost allocations between the traditional method and the activity-based costing approach 2. GK Hifi sells audio and video equipment and car studio products. After prfoming smudy and car studio products, After performing a study of fixed and variable costs in the prior year, the company prepared a prodact line proit statement as follows: GK Hif Profitability Analysis For the year ended 12/31/06 Car Total Less: Variable Costs of| 1.800.000 | 1,260,000 | 600.000 part-time 120,000 30,000 230,000 variable 1.920,000 1,340,000 630,000 1,080,000460,000 $70,000 2.110,000 Less direct Fixed Costs: Salary, full time300,000 staff Less common 250,000 210,000 760,000 costs Advertising Utilities Other administrative costs Total common fixed costs 110.000 20,000 560,000 690,000 660,000 Profit Required: a. Calculate the contribution margin ratios for audio, video and car product lines b. What would be the effect on profit of a $1000,000 increase in sales of audio equipments Page 5 compared with a S1000,000 increase in sales of video equipment, or a $1000 Framination-Spring Semester, May-june'2018],JGBS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts