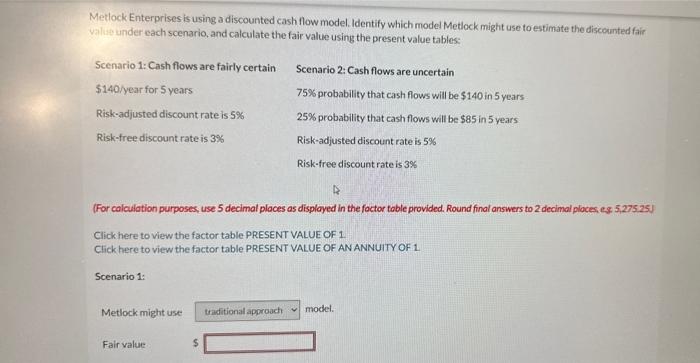

Question: Metlock Enterprises is using a discounted cash flow model. Identify which model Metlock might use to estimate the discounted fair value under each scenario, and

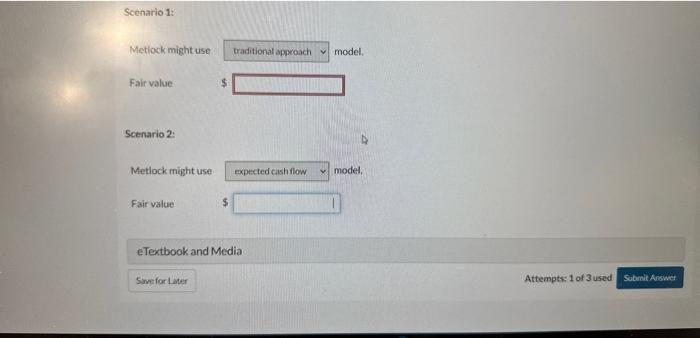

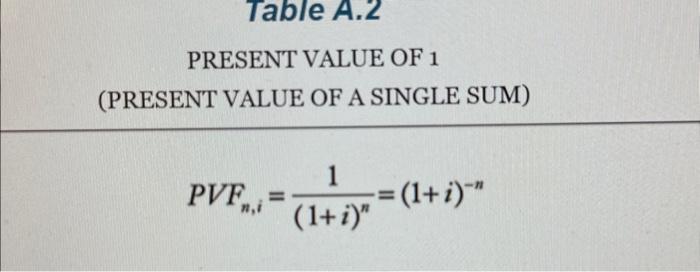

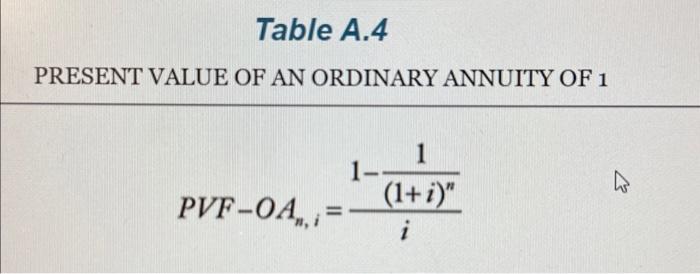

Metlock Enterprises is using a discounted cash flow model. Identify which model Metlock might use to estimate the discounted fair value under each scenario, and calculate the fair value using the present value tables: (For calculation purposes, use 5 decimal places as displayed in the foctor table provided. Round final answers to 2 decimal ploces, eg 5,275,25 ) Click here to view the factor table PRESENT VALUE OF 1 Click here to view the factor table PRESENT VALUE OF ANANNUITY OF 1 Metlock might use Fair value Scenario ?: Metlock might use Fair value PRESENT VALUE OF 1 (PRESENT VALUE OF A SINGLE SUM) PVFn,i=(1+i)n1=(1+i)n PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 PVFOAn,i=i1(1+i)n1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts