Question: Metlock Inc wants to replace its current equipment with new high-tech equipment. The existing equipment was purchased 5 years ago at a cost of $121,000.

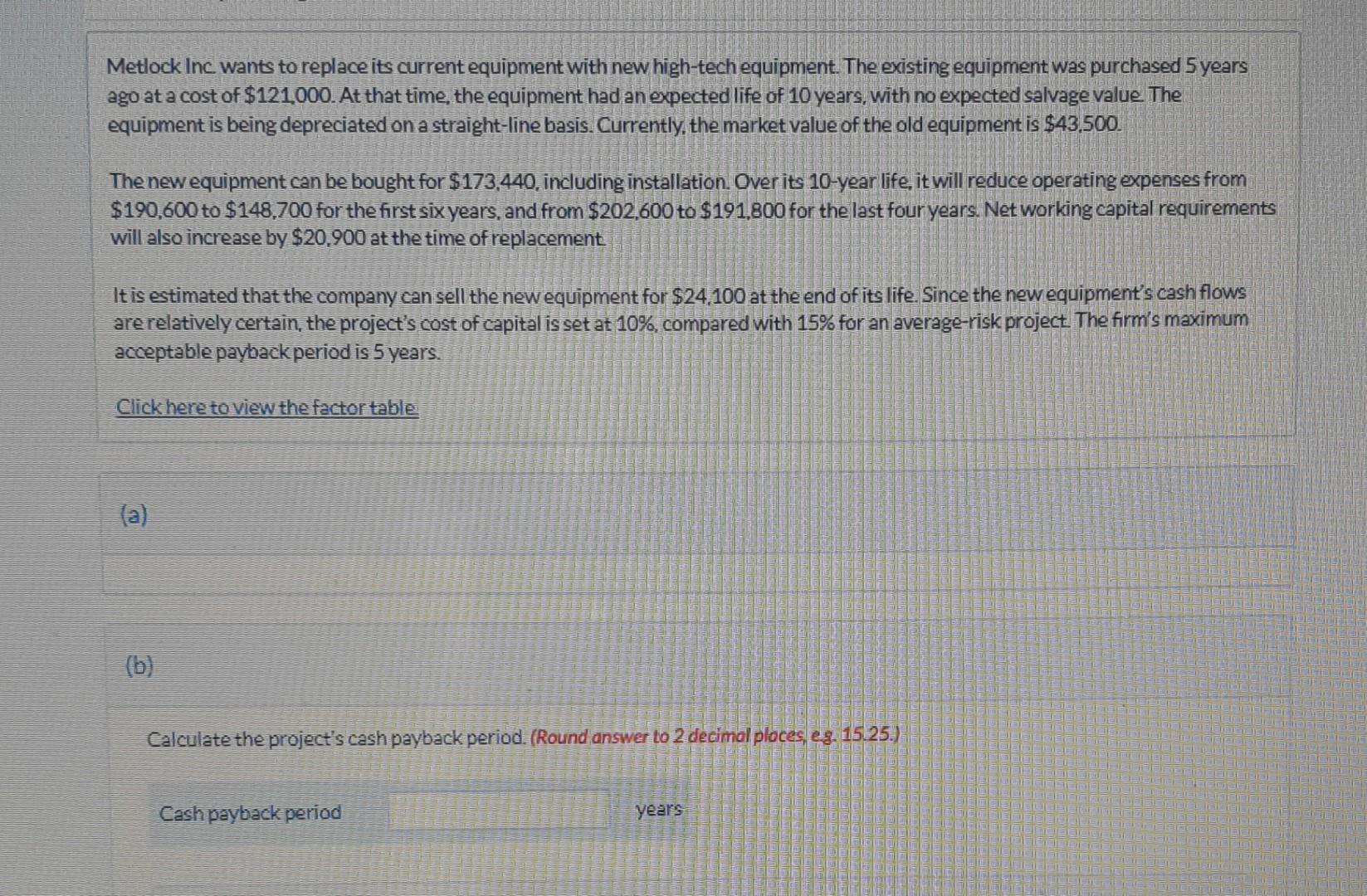

Metlock Inc wants to replace its current equipment with new high-tech equipment. The existing equipment was purchased 5 years ago at a cost of $121,000. At that time, the equipment had an expected life of 10 years, with no expected salvage value The equipment is being depreciated on a straight-line basis. Currently, the market value of the old equipment is $43,500. The new equipment can be bought for $173,440, including installation. Over its 10 -year life, it will reduce operating expenses from $190,600 to $148,700 for the first six years, and from $202,600 to $191,800 for the last four years. Net working capital requirements will also increase by $20,900 at the time of replacement It is estimated that the company can sell the new equipment for $24,100 at the end of its life. Since the new equipment's cash flows are relatively certain, the project's cost of capital is set at 10\%, compared with 15% for an average-risk project. The firm's maximum acceptable payback period is 5 years. Click here to view the factor table (a) (b) Calculate the project's cash payback period. (Round answer to 2 decimal ploces, eg. 15.25.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts