Question: mework: Chapter 11 Homework Save re: 0 of 2 pts 12 of 14 (0 complete) Hw Score: 0%, 0 of 20 pts 1-26 (book/static) Question

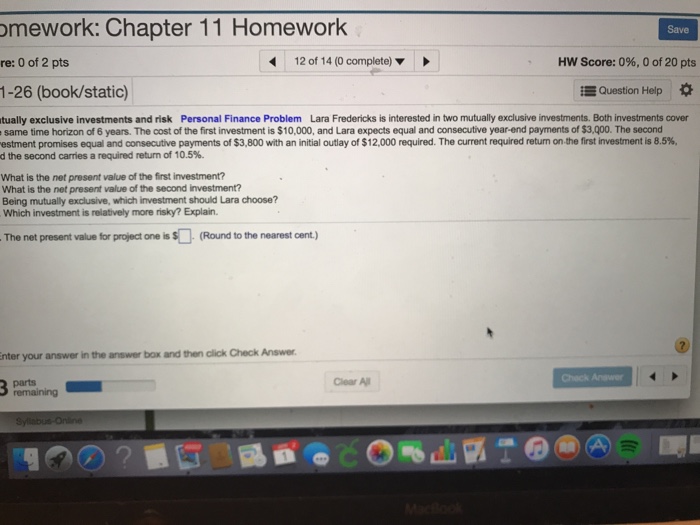

mework: Chapter 11 Homework Save re: 0 of 2 pts 12 of 14 (0 complete) Hw Score: 0%, 0 of 20 pts 1-26 (book/static) Question Help * tually exclusive investments and risk Personal Finance Problem Lara Fredericks is interested in two mutually exclusive investments. Both investments cover same time horizon of 6 years. The cost of the first investment is $10,000, and Lara expects equal and consecutive year-end payments of $3,000. The second estment promises equal and consecutive payments of $3,800 with an initial outlay of $12,000 required. The current required return on the first investment is 8.5% dthe second carries a required return of 10.5%. What is the net present value of the first investment? What is the net present value of the second investment? Being mutually exclusive, which investment should Lara choose? Which investment is relatively more risky? Explain. The net present value for project one is $(Round to the nearest cent nter your answer in the answer box and then click Check Answer Clear A Chack Anwer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts